Crypto lending: too good to be true?

TL:DR Crypto lending today is primarily driven by speculation. Brokerage margin lending is the closest real-world comparison, justifying current crypto rates of 8–10%.

TL:DR Crypto lending today is primarily driven by speculation. Brokerage margin lending is the closest real-world comparison, justifying current crypto rates of 8–10%. As more potential lenders get comfortable with the technical risks, the supply of lenders will start to outweigh the demand of borrowers and margins will eventually compress. While speculation is the primary use case for crypto lending, I am optimistic there will be additional use cases for crypto lending as the technology and ecosystem matures (credit scoring, insurance, etc.)

Crypto lending has grown significantly over the past 18 months and has gained even more attention as of late given attractive interest rates relative to typical savings accounts that earn roughly 2% APR.

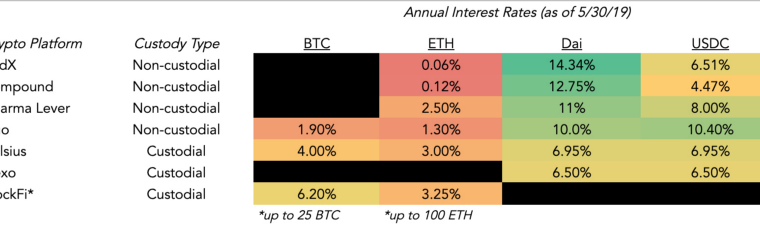

Looking at a P2P crypto lending platform like Dharma, lenders can currently earn 8% by lending their USDC, a USD stablecoin formed as a partnership between Circle and Coinbase and 11% for Dai, MakerDAO’s stablecoin that is also designed to be pegged to $1 USD.

On the surface, these rates may sound too good to be true. But, for every lender, there must be a borrower. So who is borrowing at double digit rates?

Crypto Lenders

Because cryptocurrencies are so volatile, almost all crypto loans are over-collateralized. In general, they require collateral ratios of 150%+ to secure a loan, which provides some safe guards for lenders to manage counterparty risk. So a potential borrower would need to put up at least $15,000 worth of crypto (BTC, ETH, etc) as collateral to get a $10,000 loan.

There are two major types of players in the crypto lending market, Custodial and Non-Custodial lenders. The main trade-off between custodial and non-custodial lenders is around Counterparty Risk (trusting a company) vs. Technical Risk (trusting code).

With custodial lending, I am trusting that the entity will safely custody my crypto assets and limit counterparty risk from potential borrowers, ensuring my loan gets paid back in full and on time.

With non-custodial lending, I trust that the smart contract code will run as designed and does not have any bugs that will result in lost funds / hacks.

Centralized, custodial lenders include companies like Genesis Capital, BlockFi, Nexo and Celsius as well as centralized exchanges like Bitfinex, Liquid and BitMEX and centralized OTC desks like Galaxy, OSL and Cumberland.

Decentralized, non-custodial credit protocols include Compound(decentralized money market protocol), Dharma (P2P lending protocol), MakerDAO (decentralized credit facility) and Uniswap (decentralized exchange that enables lenders to provide liquidity).

While there is certainly nuance between all of the above examples, these decentralized protocols are slowly emerging as competitors to centralized, custodial credit providers and differ mainly on lending rates & custody management.

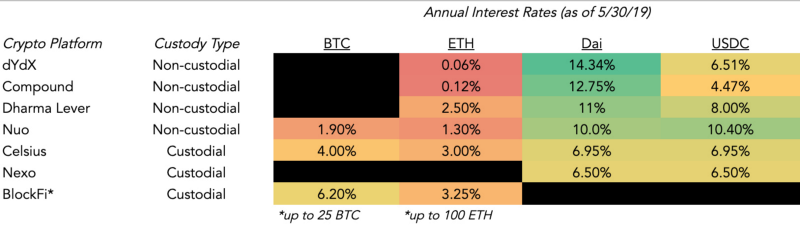

However, centralized providers are still the largest crypto lenders today, with Genesis Capital, originating over $1.5B in annualized volume alone:

Crypto Borrowers

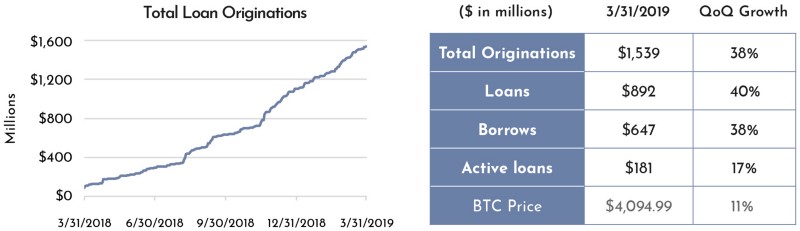

Genesis Capital outlines 3 main use cases for borrowing cryptocurrencies from their clientele:

1. Speculating / Hedging

2. Trading / Arbitraging

3. Operating Working Capital

A majority of crypto-backed loans seem to be speculative in nature, such as gaining additional exposure to a digital asset with leverage, shorting a digital asset you believe may be overvalued or taking advantage of arbitrage opportunities across exchanges.

The crypto community has embraced a cultish culture of “hodling” instead of selling during periods of volatility, so a portion of hodlers are likely using their crypto as collateral for working capital / loans. This can be especially advantageous for US investors as they can avoid tax liabilities by borrowing as opposed to selling their crypto and triggering a taxable event. (disclaimer: this is not tax advice and you should consult an accountant).

Lastly, crypto-native organizations who need operating working capital can take out loans with their balance sheets as collateral. Indeed we saw this happen more frequently in the bear market:

So out of these three potential borrower bases, we can see roughly 2/3rds of the lending volume in Q3 was driven by speculators / trading activity, rather than accessing working capital. As we emerge from the bear market, I’d speculate that the “working capital” borrowers will become a smaller % of total lending volume as market conditions continue to turn bullish.

Intuitively this makes sense for non-custodial lending activity as well and I’d argue even more of non-custodial crypto lending activity today is driven by speculators.

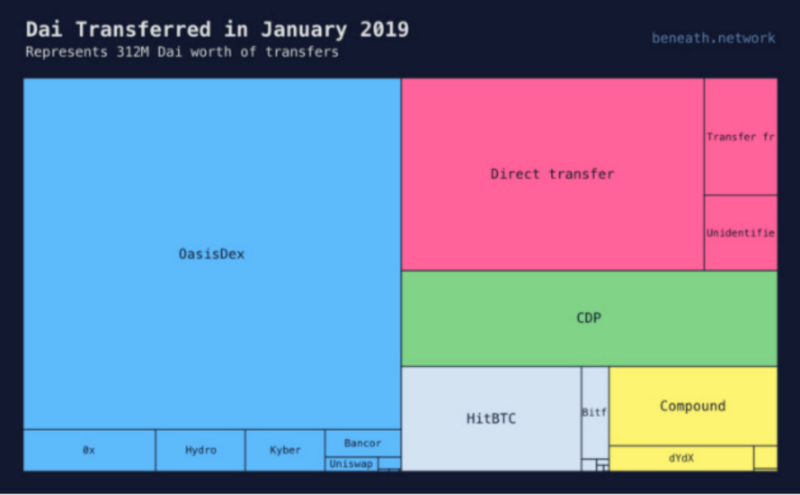

Looking specifically at activity by users of MakerDAO’s Dai, we can see a majority of transfers were sent to decentralized exchanges such as OasisDEX (recently rebranded to eth2dai) and centralized exchanges like HitBTC, presumably to purchase cryptocurrencies as ETH is the only trading pair on OasisDEX/eth2dai and HitBTC is a crypto-only exchange (ETH/DAI is by far the most liquid Dai pair on HitBTC with $2.3M in 24h volume compared to $30k for USDT/DAI as of 5/29/2019).

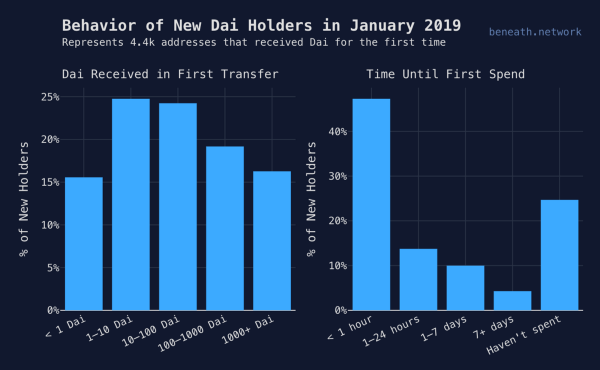

The selling of DAI on exchanges for other cryptocurrencies recently caused Dai to de-peg, as holders immediately sell their Dai for other assets (over 45% of Dai is first spent within an hour). Without anything to offset this natural selling pressure, the price of Dai fell under $1.00 in Q1 2019, although it has since rebounded after a series of stability fee increases.

Historical DAI / USDC price on Coinbase

Looking at the operating working capital use case, there has been some anecdotal evidence that crypto projects have been taking loans out via MakerDAO using their ETH treasury holdings as collateral (Aragon’s $1M CDP).

And maybe a portion of DAI-hards are willing to stomach double-digit borrow rates instead of selling their precious ETH…

Yes, there are probably a minority of early adopters who want to avoid a large tax bill…

But the strict over-collateralization requirements of these loans likely means that a retail consumer is likely not the typical borrower. On the aggregate, if a potential borrower needs to take out a loan for working capital (to pay off a bill, mortgage, etc.), wouldn’t they just sell a portion of their 150%+ crypto collateral or use a centralized loan provider at a lower rate before taking on a burdensome 15%+ APR loan?

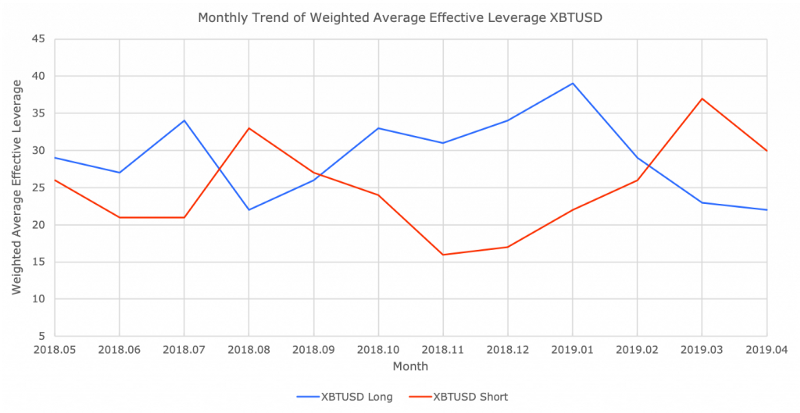

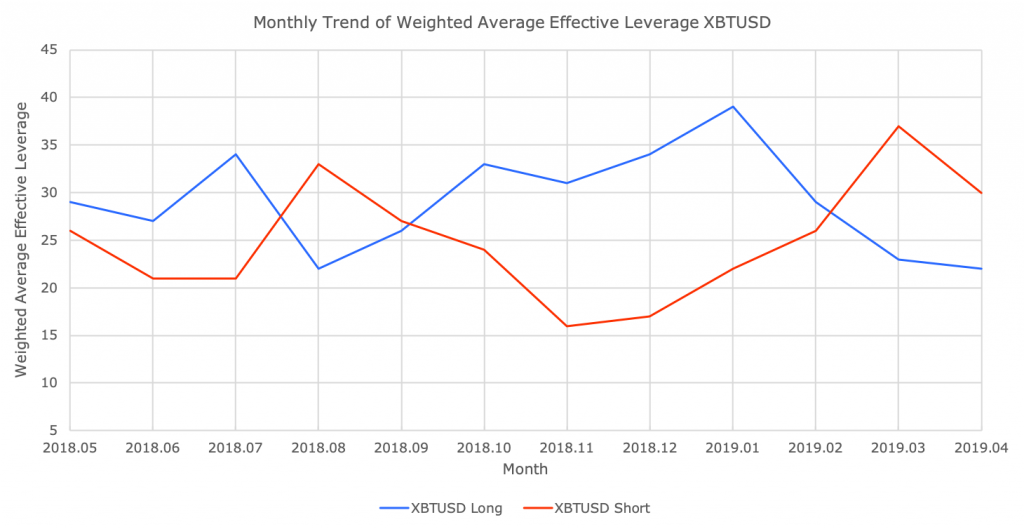

In such a volatile asset class, where Bitcoin can move 20% within an hour, I’d wager speculators are likely the most willing to borrow at these high costs to either gain leverage or short an asset as the profits may outweigh the costs. Crypto is a casino, after-all:

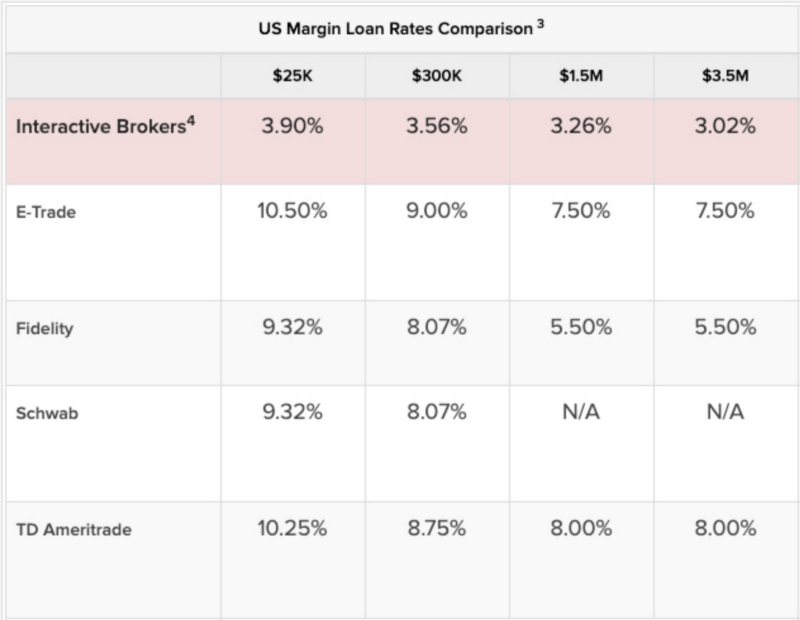

So if we accept the assumption that the majority of crypto lending today is driven by speculators, rather than access to working capital, the closest comparison for crypto lending rates are brokerage margin loan rates. Under that lens, crypto rates start to make a little more sense.

Brokerage margin lending is profitable and relatively low risk given the collateral requirements. However, there is currently no way for the average user to supply capital and earn a profit (unless you are the broker).

The unique innovation in crypto lending is that for the first time, lending platforms are able to open up the supply side via smart contracts. While some custodial lenders like Genesis and BlockFi supply capital and capture the lending margin themselves, other custodial providers like Celsius and Nexo, in addition to non-custodial lenders like dYdX, Dharma and Compound have opted to democratize the supply side.

The big implication being that, for the first time, any one in the world can now supply liquidity to potential borrowers and earn 8–10%+ APR, in a completely permissionless manner. Pretty powerful.

It’s important to note that Ethereum smart contracts are still nascent, and therefore hold a high degree of technical risk (see: Parity multi-sig hack, DAO, etc). While there is currently over $500M+ of ETH locked up in smart contracts across non-custodial lending platforms (a pretty big bug bounty), formal verification tools and the emergence of insurance solutions will slowly lower technical risks, in addition to time.

A few interesting examples of crypto native smart contract insurance providers are defisurance, which leverages Augur prediction markets to insure deposits and Nexus Mutual, a digital cooperative/mutual that covers members against smart contract failure.

While we are still far away from traditional insurance providers securing smart contracts as they have just starting to explore insuring custodians, any centralized / decentralized insurance solution will significantly drive adoption and start to level the playing field vs. centralized lending providers.

After taking into account the technical risks associated with crypto lending, higher APR’s for stablecoins relative to brokerage margin rates start to make sense and are still relatively underpriced given the current state of smart contracts and lack of insurance. Most recently, Zeppelin identified a minor bug in MakerDAO’s governance contractduring Coinbase Custody’s audit process. While this bug had minimal impact and wasn’t related to the main set of lending smart contracts, it’s important to be realistic about how nascent this technology is.

The Future of Crypto Lending

To answer the question of how sustainable the current crypto lending markets are, it helps to take a step back and look at the aggregate supply and demand. If we indeed assume that the majority of crypto lending borrowers today are speculators, I imagine the “demand side” will continue to grow as crypto continues gaining adoption and remains a volatile asset class.

However, it’s far more likely that as potential lenders eventually get comfortable with the risk/reward trade-off and realize they too can earn 8%+, the supply side will eventually outpace the current demand from speculators.

The most likely scenario is that crypto lending rates will continue to increase in periods of significant volatility, but decrease on the aggregate as more individuals/entities begin to supply liquidity and enter the space.

What remains to be seen is if crypto lending can start to address new use cases beyond speculation and further grow the demand side. I’m particularly excited to see the emergence of decentralized credit scoring solutions enter the crypto lending space, as they will lower the restrictive 150%+ collateral requirements and open up the supply of potential borrowers.

By combining the powerful innovation of opening up the lending supply side, introducing decentralized credit & insurance solutions, and lowering the cost to serve via smart contracts, I’m optimistic we’ll start to see crypto lending solutions address emerging markets that traditional financial institutions have historically ignored.

Please reach out if you are working on any part of the decentralized lending stack: roy@wavegp.com.

DISCLAIMER:

This informational piece is intended to inform Wave Digital Assets’s audience of the current status of the crypto industry. Nothing in this material should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product. Wave Digital Assets LLC is a registered investment adviser, registered with the state of California. Registration with the SEC or state authority does not imply a certain level of skill or training. Additional information including important disclosures about Wave Digital Assets LLC also is available on the SEC’s website at www.adviserinfo.sec.gov. Or, learn more information about Wave Digital Assets at www.wavegp.com.

Roy Learner is an Associate at Wave Digital Assets. The views expressed in this report reflect Roy Learner’s personal views about the subject companies, platforms, issuers, security and non-security investments (“investments”) and not those of Wave Digital Assets. Roy Learner’s comments are not intended to be construed as recommendations or an offer to buy, sell or hold any investment. Roy Learner’s compensation is not directly or indirectly related to the specific recommendations or views contained in the research report. The ecosystem landscape included in this post is intended to provide generalized guidance; nothing in this analysis is intended as investment advice, a recommendation or an introduction to particular funding or capital resource.