Bitcoin Halving: A Catalyst for Crypto Resilience and Value Appreciation

04.01.2024

Wave Leadership Thoughts by Nauman Sheikh

The Impending Bitcoin Halving: The Next Catalyst

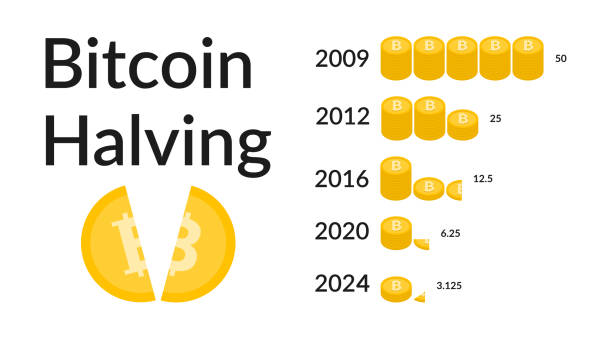

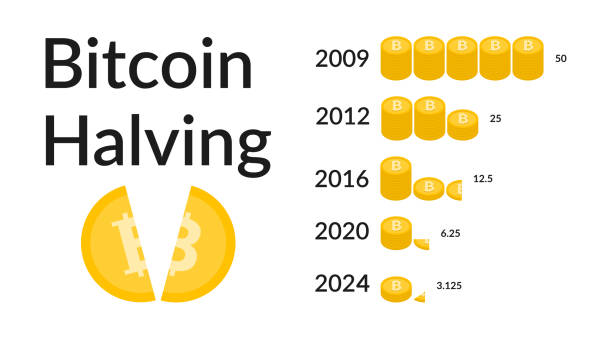

The crypto landscape is on the cusp of a significant event—the upcoming Bitcoin halving is just 3 weeks away, estimated to be on April 19th. The halving is a predefined event occurring every 210,000 blocks, roughly every 4 years. Mining rewards will be reduced by half, from 6.25 to 3.125.

In previous halving cycles, bitcoin rallied going into the halving only to sell off a couple of weeks before the actual event. The sell off in the past has been quite aggressive given the over levered market positioning leading into the event and the subsequent cascading liquidations that ensued.

So far in this cycle, the price performance has echoed previous halving cycles to a large degree. Current market positioning is again showing many signs of levered longs. The aggregate open interest in bitcoin futures at $20bn is higher than the previous bitcoin peak in November 2021. Also, the perp funding spreads have recently been as high as 95% p.a. although it has now settled down again to 20-30% p.a. range. In the options market, the upside call skew is being bid up much more aggressively compared to downside skew. All of this sets the stage for a potentially aggressive sell off in the short term – a typical “sell the news’ event.

Market positioning aside, in terms of liquidity and economic fundamentals, all conditions are ripe for a stellar performance for bitcoin post halving. ETF NET inflows have been $12bn in the 1st quarter (adjusting for GBTC outflows). The $21.5bn inflows that Blackrock and Fidelity have seen is beyond expectations. This is only set to continue as the RIA channels open up.

Recent inflation numbers were on the stronger side which has pushed the Fed into a stance of being data dependent despite the dot plots projecting 3 interest rate cuts in 2024 following the March FOMC. However the Fed may have to bear the stubbornly sticky inflation rate for the time being as it’s dealing with a potential CRE crisis, balance sheet crisis for smaller banks, interest payments on its $34tr debt and of course election year. Sticky inflation and a cap on interest rates effectively lower real rates – bad for fiat, good for bitcoin, gold and stock market.

This confluence of market dynamics, enhanced institutional interest, and favorable macroeconomic conditions paints a highly optimistic picture for Bitcoin and the broader crypto space for the remainder of the year. As these elements converge, they not only underscore Bitcoin’s resilience and growing acceptance but also signal a promising horizon for digital assets as a whole, potentially marking this year as a pivotal moment in crypto’s mainstream integration and value appreciation.

Latest News:

WELCOME FRIENDS: Hundreds of institutions and prominent individuals have invested directly in crypto, adopted the value thesis, or started building technology to support digital assets since Wave started tracking these developments in late 2020. Now the rise of the Metaverse, Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs) is driving mainstream adoption of blockchain technologies everywhere we look. We’re continuing to keep track of it every week here:

- Google has expanded its search engine functionality to include blockchain data from various networks like Bitcoin and Ethereum, including Fantom. Users can now search for specific blockchain addresses directly within Google’s search engine and access transaction details through ‘rich’ results. Despite some users reporting that the feature isn’t universally available, Google has quietly indexed blockchain data for Fantom and four other EVM-compatible chains. This development aligns with Fantom’s efforts to revitalize its image, particularly with its innovative Sonic technology, as its FTM token has surged by over 110% in the past month.

- Fidelity Investments (Fidelity) has filed a registration with the United States Securities and Exchange Commission (SEC) to apply for a spot Ethereum (ETH) exchange-traded fund (ETF). Notably, the filing featured an option to stake a portion of the fund’s assets. According to the S-1 filing, the proposed ETF would be available for trading on the Cboe BZX Exchange, with Fidelity’s digital asset division serving as the custodian of the trust’s Ethereum holdings. However, Fidelity has not specified which staking infrastructure they will be using or partnering with.

REGULATORY ROUNDUP: We’re living through the era of regulatory recognition of digital assets. The legislation, litigation, and regulation happening today will dictate the entire future of our industry, and we have a historic chance to shape those changes by staying informed and providing public comment.

- Sam Bankman-Fried, the founder of collapsed cryptocurrency exchange FTX, received a 25-year prison sentence today. SBF was found guilty on seven counts of fraud last year related to stealing FTX customer money and lying to investors and creditors. During sentencing, Judge Kaplan stated that SBF “will be in a position to do something very bad in the future” and chided SBF for not showing remorse. While not admitting fault, SBF did apologize for the collapse of FTX and his defense team vowed to appeal both the conviction and the sentence.

- Kucoin has been charged with violations of the Commodity Exchange Act by the US CTFC. The CTFC charged Kucoin for illegally dealing in off-exchange commodity futures transactions and accepting orders for commodity futures, swaps, etc. without registering with them as a futures commission merchant.

- In a recent court ruling, both the SEC and Coinbase secured partial victories in their ongoing legal dispute. The court rejected most of Coinbase’s attempts to dismiss the SEC’s lawsuit, acknowledging the SEC’s claims regarding Coinbase’s operations as a clearing agency, broker, and exchange, while also ruling that Coinbase’s staking program constitutes the unregistered offer and sale of securities. However, the court granted Coinbase’s motion regarding its wallet service, finding insufficient evidence to support the claim that it acts as an unregistered broker in that aspect.

DISCLOSURE:

THE OPINIONS EXPRESSED HEREIN ARE THOSE OF THE AUTHOR ALONE AND DO NOT REPRESENT WAVE DIGITAL ASSETS LLC OR ANY OF ITS AFFILIATES. CERTAIN INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES, HAS NOT BEEN INDEPENDENTLY VERIFIED AND IS BELIEVED TO BE ACCURATE AS OF THE DATE OF ITS PUBLICATION ONLY. CERTAIN WAVE ACCOUNTS HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED HEREIN. WAVE AND/OR THE AUTHOR MAY HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED.

NOTHING IN THIS EMAIL OR LINKED INFORMATION SHOULD BE INTERPRETED AS AN OFFER OR RECOMMENDATION TO BUY, SELL OR HOLD ANY SECURITY OR OTHER FINANCIAL PRODUCT. WAVE IS FEDERALLY REGULATED BY THE US SECURITIES & EXCHANGE COMMISSION AS AN INVESTMENT ADVISER. REGISTRATION WITH A FEDERAL OR STATE AUTHORITY DOES NOT IMPLY A CERTAIN LEVEL OF SKILL OR TRAINING. ADDITIONAL INFORMATION INCLUDING IMPORTANT DISCLOSURES ABOUT WAVE DIGITAL ASSETS LLC ALSO IS AVAILABLE ON THE SEC’S WEBSITE AT WWW.ADVISERINFO.SEC.GOV. OR, LEARN MORE INFORMATION ABOUT WAVE DIGITAL ASSETS AT WWW.WAVEGP.COM.