Blockchain-Based Gaming

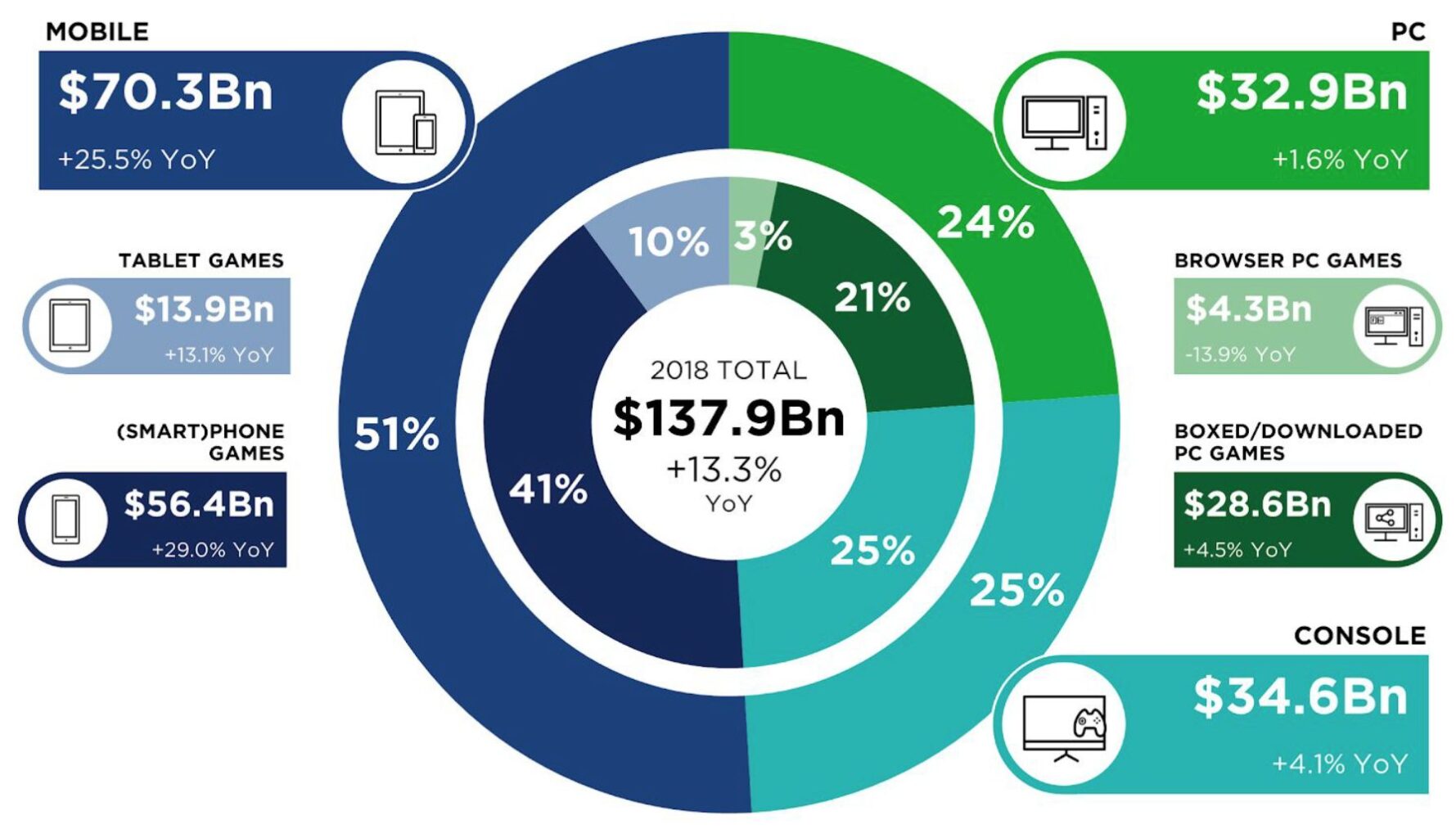

The global games industry is $138Bn by revenue and has grown $67Bn in the last five years, driven by the explosion of mobile gaming. Hence, today blockchain-based games are a small but growing piece of the global gaming industry.

Video Game Addressable Market

- The global games industry is $138Bn by revenue

- The industry has grown $67Bn in the last five years, driven by the explosion of mobile gaming

- ~$5Bn in total transactions1 were processed on the Ethereum, EOS and TRON blockchains in 2018

- Hence, today blockchain-based games are a small but growing piece of the global gaming industry

Blockchain-Based Gaming Rationale

Smart Contracts for Fair Gameplay

- Today most gaming software (the graphics, the gameplay and the currency) is all proprietary

- Everything is controlled by operators, which puts players at the whim of changes by game developers and publishers

- With blockchain-based games, developers can program open-source smart contracts to determine payout functions, ensuring fairness in gameplay

Fungible Tokens as Currency

- Blockchain-based games can use cryptocurrencies (fungible tokens) as a cross-platform payment mechanism

- Many existing games have their own in-game currency. Unless they are cryptocurrencies, their value is not transferable to other games

- Cryptocurrencies as a payment mechanism are the only way that smart contracts can process and issue digital assets

Non-Fungible Tokens for Digital Assets

- A non-fungible token (NFT) can be used to uniquely identify an asset in a game (i.e. a rare sword won from a particular boss or a gamer’s reputation)

- If many different games use the same NFT standard for in-game assets, creations will have resale value outside of their game and be traded in marketplaces

Blockchain and Video Gaming Have an Interconnected History

It’s arguable that digital assets in video games led to the emergence of cryptocurrency

World of Warcraft Gold

- World of Warcraft has an in-game currency (which was uncommon at the time) called World of Warcraft Gold

- The process was simple: purchase the gold with fiat currency and then use it to buy things in the game. Certain items that could be stolen from some of the toughest bosses became extremely valuable

- Given the popularity of WoW, this marked the emergence of digital assets with real value at scale

Digital Asset Farmers

- Gamers who recognized the emergence of digital assets with real value began “farming” these rare items and selling them for a premium at a later date

- This is seen by many as the predecessor to crypto mining

- Brock Pierce, Jonathan Yantis and Steve Bannon (then of Goldman Sachs) joined forces at Internet Gaming Entertainment (IGE), entered around this concept

WoW Gold vs. Crypto

- WoW gamers became comfortable with these online transactions, digital markets, & converting their digital money back into fiat

- The difference between WoW Gold and Bitcoin is that the Gold is centrally owned and possessed by developers, while Bitcoin is owned/possessed by players in their digital wallets

- The central ownership of Gold allowed developers to halt transactions and ban users from “misbehaving”

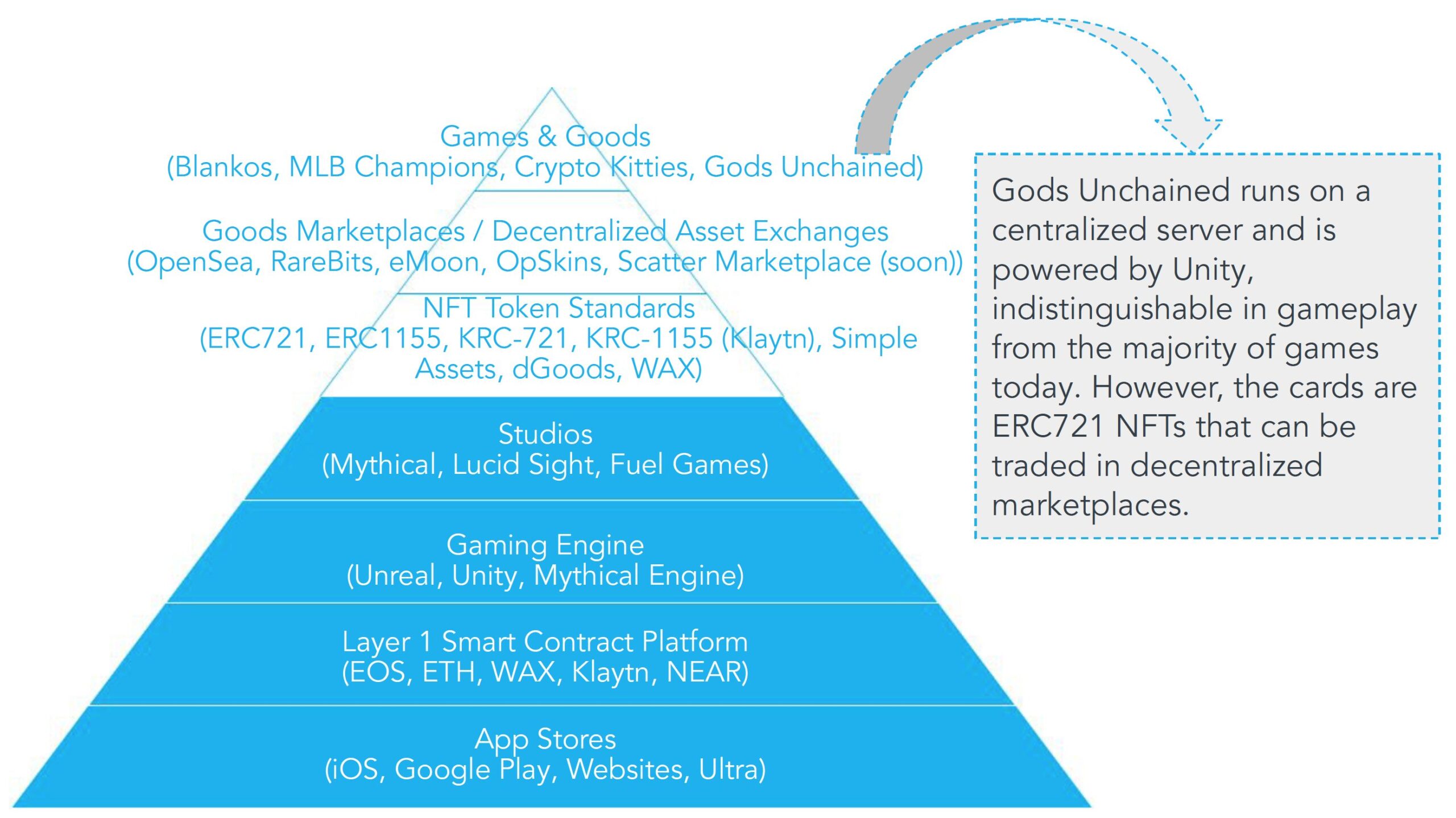

The Blockchain Gaming Stack

Two Types of Blockchain Games Today

Roleplay or Collectibles

- Most blockchain-based games in the market today are either roleplay games or digital collectible games

- Roleplaying games are essentially dynamic digital collectible games, where items in the storylines develop tradeable value

Gambling

- Blockchain gambling dApps have become the easiest onramp to gambling for users, as most blockchain gambling sites are not licensed

- Cryptocurrency, decentralization, and smart contract integration helps to bring transparency to payout models in online gambling and solves many of the industry’s fundamental pitfalls

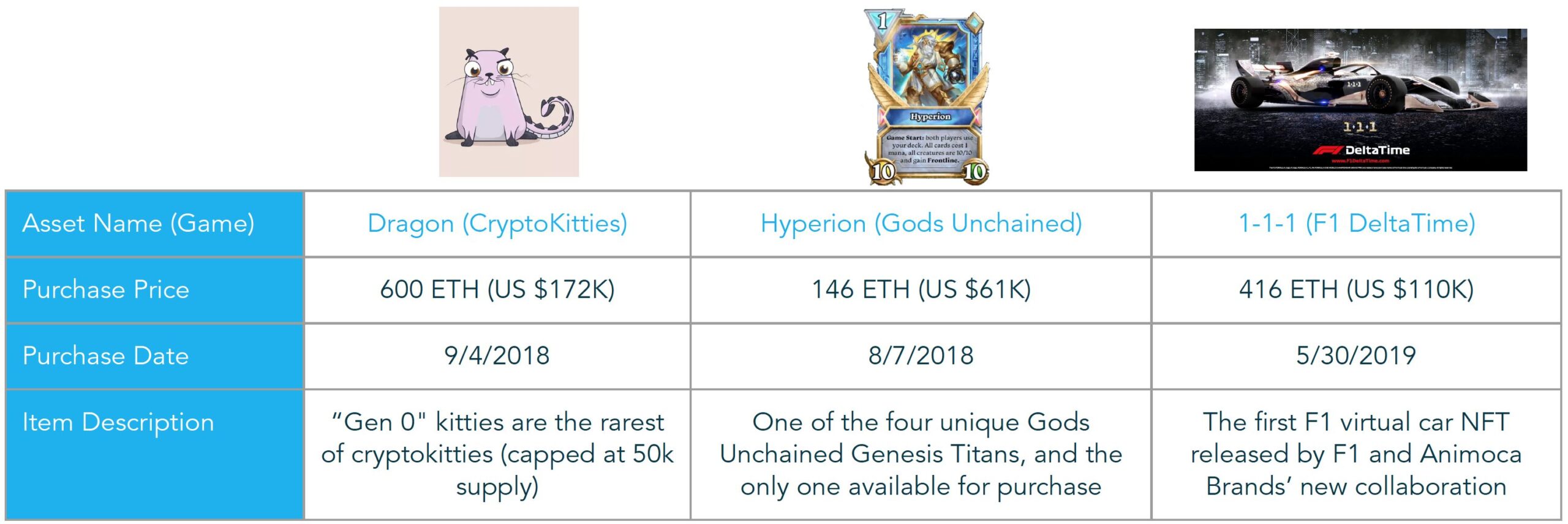

Digital Collectibles Have Proven, Real-World Value

How much would a fan pay to own an original character of Fornite legend Ninja after he retires?

- If blockchain can prove players truly own certain assets, the gaming community is passionate enough that they would pay substantial amounts for certain items

- The limited number of games that have integrated blockchain have proven this to be true

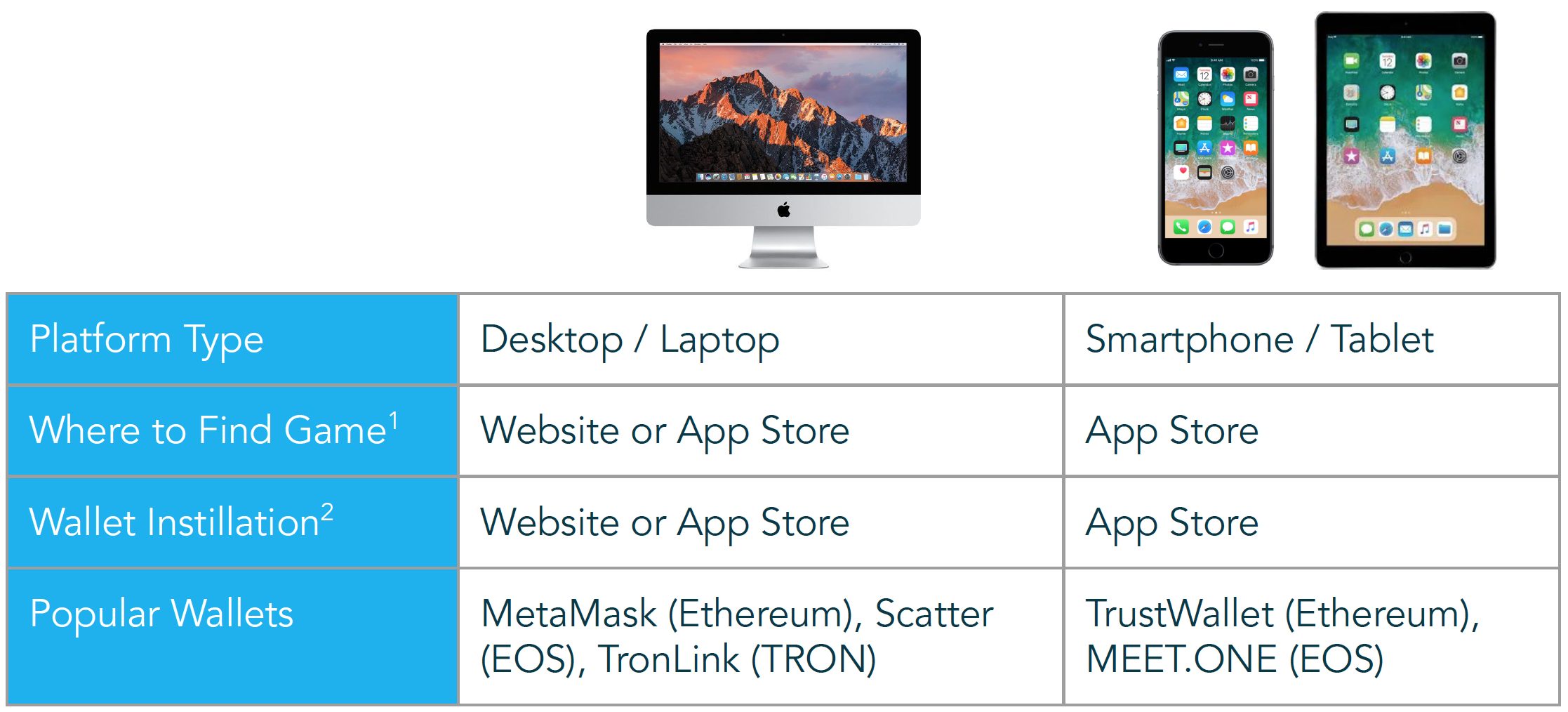

How to Access Blockchain-Based Video Games

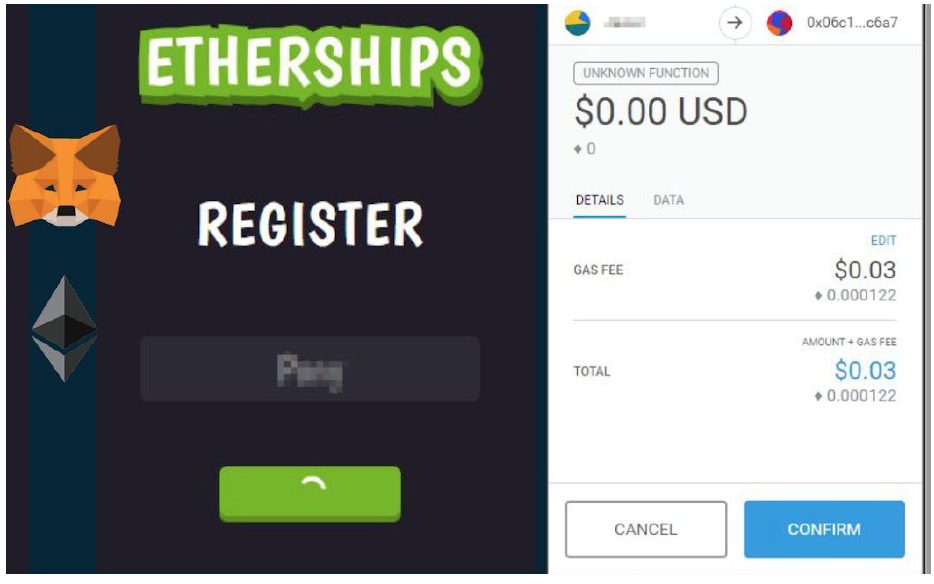

For now, all blockchain-based video games are PC and mobile based. Players are connected through hot wallets

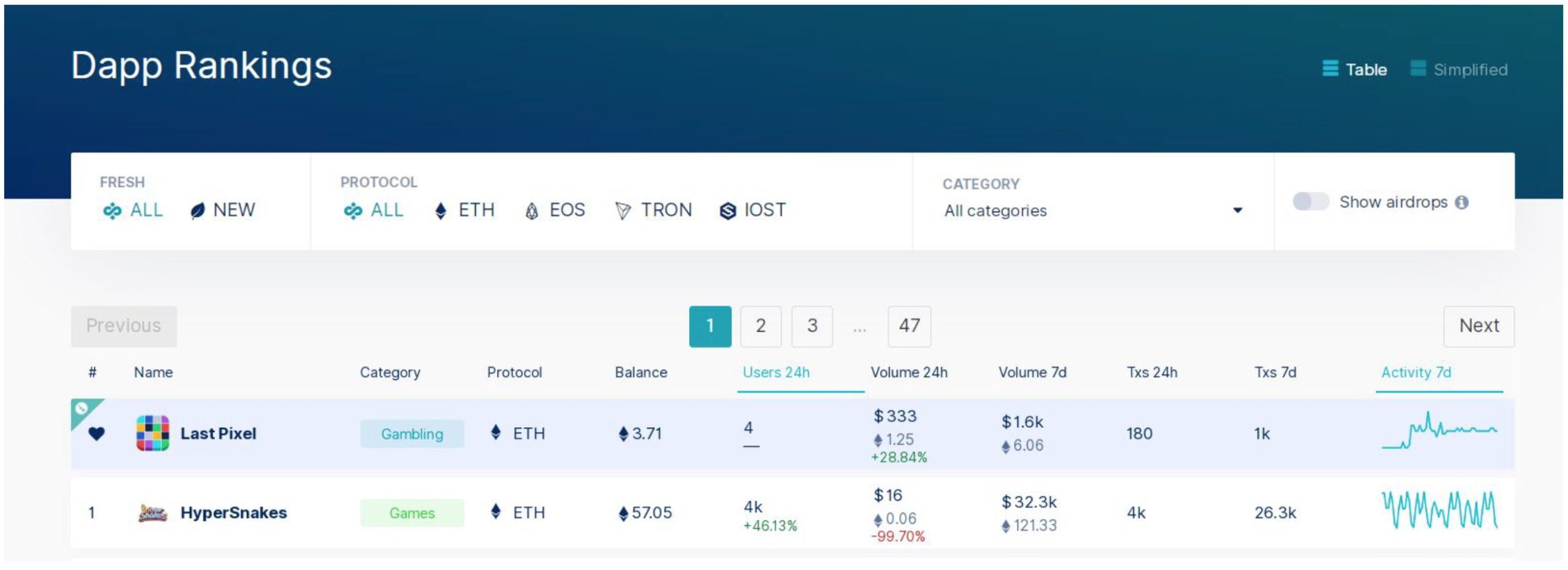

Blockchain Game Analytics

DappRadar is the main analytics platform and ranking engine for blockchain dApps that tracks number of users, number of transactions and transaction volume per game

- dApps with the highest usage are games, despite the hype around decentralizing all types of applications

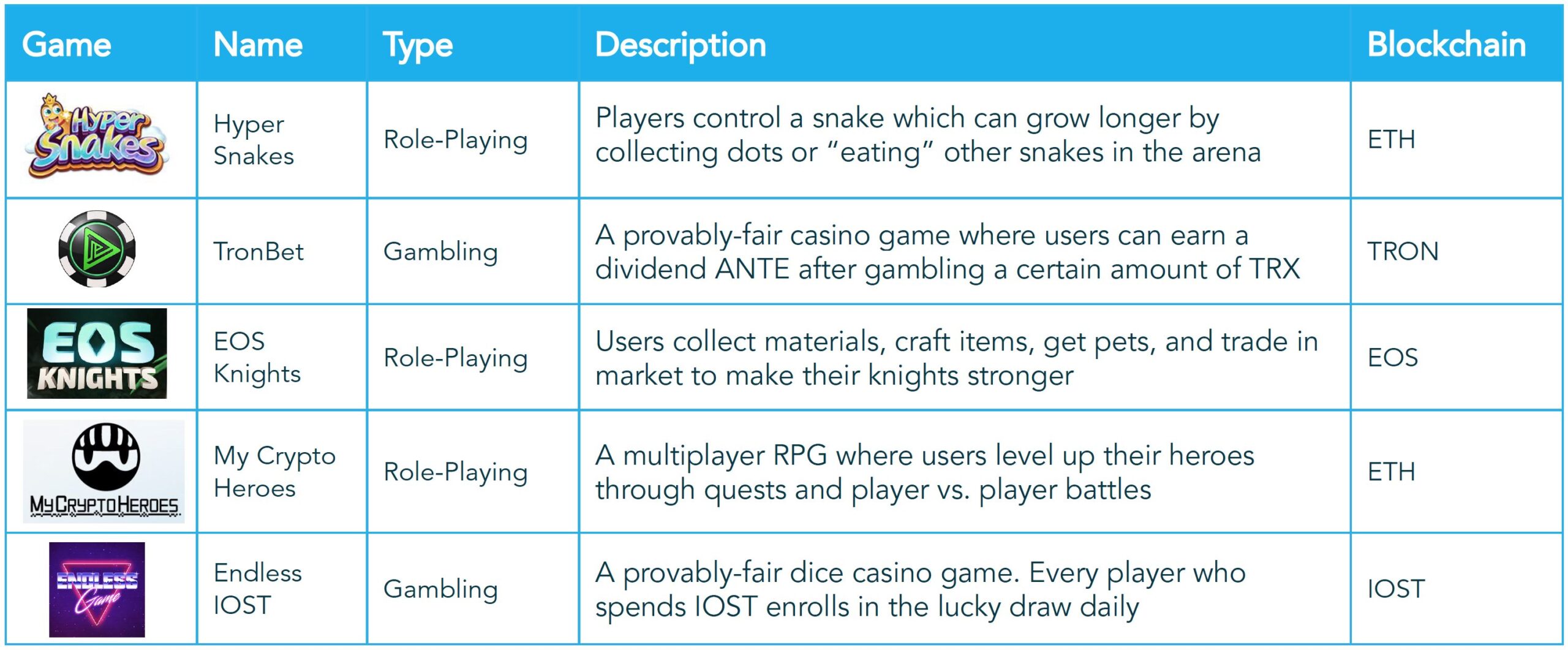

Top 5 Blockchain Games on DappRadar Today

Rankings as of 6/18/19, ranked by number of users. Unclear today how much usage is real vs. artificially created by bots.

Leading investors for blockchain gaming

Challenges for Blockchain-Based Gaming

1. Onboarding:

- Getting gamers to join the blockchain is a pain

- Can developers make the blockchain invisible?

2. Item-first gaming is expensive:

- You need to buy items to play

- Can we make games F2P? i.e. Cryptage Origins

3. Transactions are expensive:

- Writing data on the blockchain costs time & gas

- Can we make Tx fast & free? I.e. Loom, Efinity, Tenfold (layer 2 solution examples)

4. Immature & inaccurate data analytics:

- How much volume is real vs. generated by bots?

What is a Non-Fungible Token?

Non-Fungible Tokens (NFTs) are unique digital representations of defined digital assets

- In the real world, the majority of luxury assets – those that are considered to have scarcity value – are non-fungible (real estate, cars, boats, art, vintage baseball cards, even people)

- Identity & reputation is another important NFT use case for gaming

Benefits of NFTs

- Transferability: because NFTs are held by the user instead of the game developer, the user has the ability to trade the NFT on third-party marketplaces without permission from the game developer

- Authenticity: the token standard helps prove ownership of the asset

Token Standards

- An NFT token standard (i.e. ERC721) is a free, open standard that defines a minimum interface a smart contract must implement to allow unique tokens (NFTs) to be managed, owned, and tradeda

Standards for Digital Asset Ownership

Today, there are three defined levels to standards for digital ownership:

Digital Assets Level 1:

- A digital asset is digital text or media, whose ownership you control inside of a game or application

Digital Assets Level 2:

- ….whose ownership can be verified on a blockchain

Digital Assets Level 3:

- …and whose controls adhere to a broadly accepted protocol so that the digital objects can be sent to third party markets

We are currently at the third level with token standards such as ERC721, dGoods and Simple Assets, which allow smart-contracts to hold an ownership database of unique items

Non-Fungible Token Ecosystem

Over 7.5M NFT Transactions in 2018

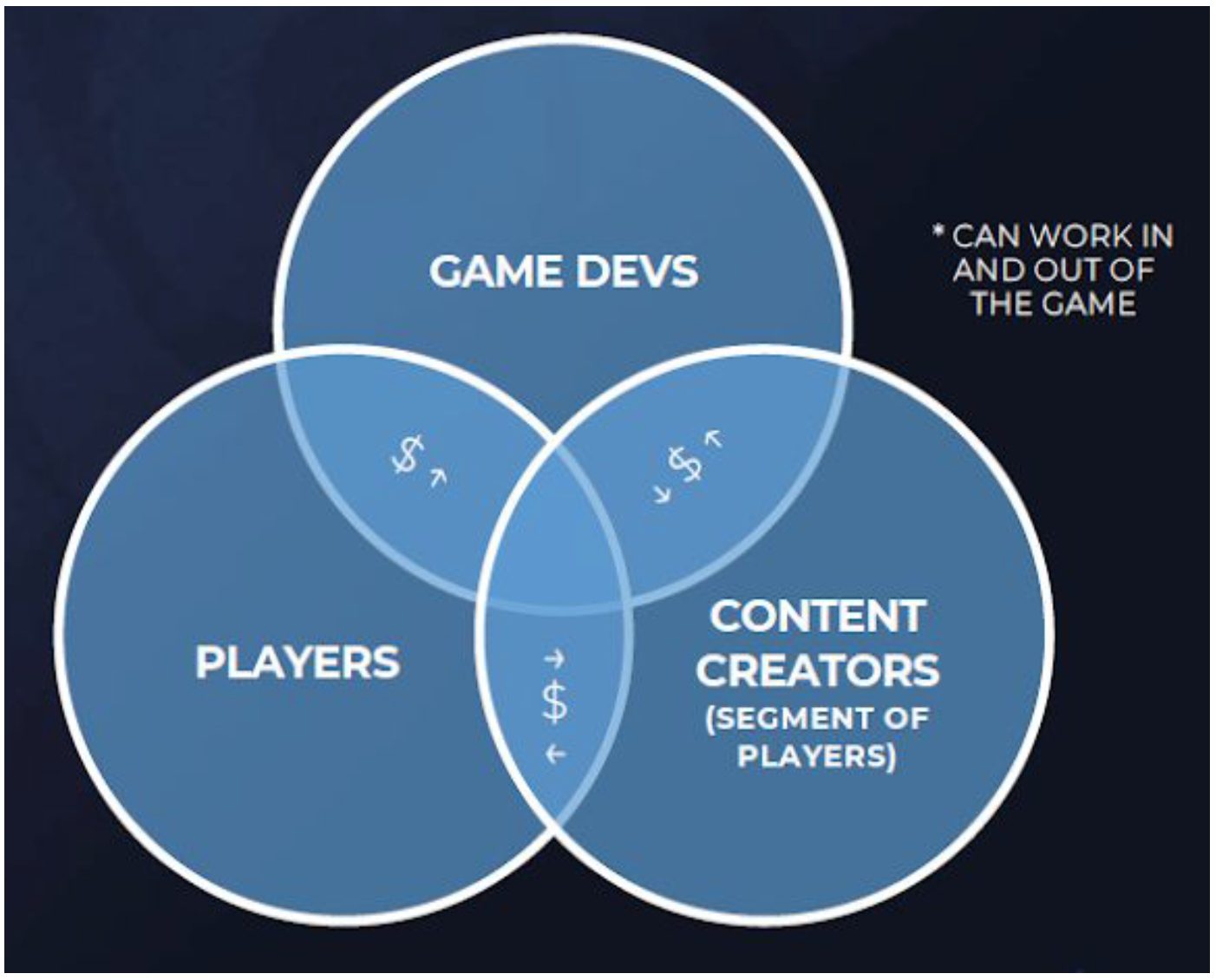

Player-Owned Economies

- Because digital creations in a game now can have real value outside of the game, developers can monetize a substantial portion of the assets they create. As a result, “player-owned” game economies are evolving

- Game developers can define what player-owned economies mean in their respective games. For example, developers can a) sell game assets (e.g. race cars) to players or content creators at wholesale, b) provide cookie-cutter tools for players to make custom modifications, and c) players can resell those new unique assets back into the game through a marketplace

- If players can create their own assets (and are motivated to do so because they can make money), this would reduce today’s 100% creation burden on developers

Case Study: Loom Network – Scaling Solution for Blockchain-Based Games

- The user experience for blockchain-based gaming is contingent on transactions having low-latency

- Rather than clogging mainchains like Ethereum or EOS, Loom Network has built an SDK that allows developers to create an unlimited number of sidechains to scale their dApps as needed

- These sidechains are connected to the mainchain through Loom’s central hub called PlasmaChain. This way, sidechains can process transactions without having to touch the Ethereum blockchain

- Loom first integrated its PlasmaChain with Ethereum in 2018, meaning PlasmaChain’s smart contract functionality is compatible with the ERC20 and ERC721 token standards

- On June 6, 2019, Loom completed its integration of PlasmaChain with the TRON blockchain

- Loom’s sidechains (i.e. GameChain) are now being used by multiple games and dApps in production

Case Study: Enjin & ERC1155 Token Standard

- Founded in Singapore in 2009, Enjin allows gamers to build their own social profiles that connect to game servers. Over 250,000 gaming communities and twenty million gamers are registered on Enjin’s platform

- Enjin is building a facilitation layer on top of Ethereum (wallets, cryptocurrency and NFT, and virtual item management apps) to make asset interoperability possible

- Enjin’s differentiator is its work on a new token standard and smart contract platform, ERC1155

- Unlike ERC721, in which a new smart contract must be deployed for each new instance of an NFT, a single ERC1155 smart contract can govern an infinite number of NFTs

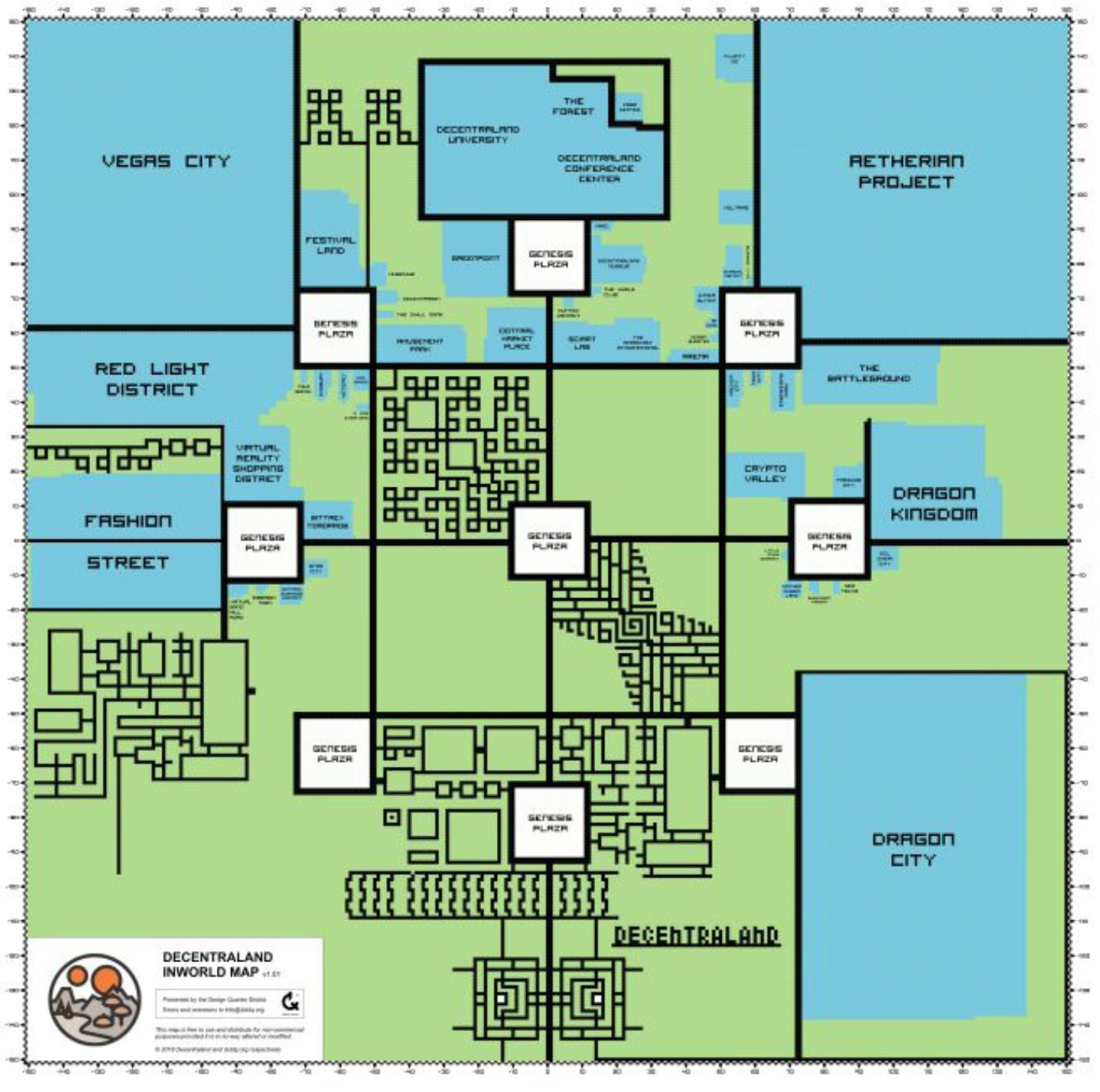

Case Study: Decentraland – Merging VR and Digital Collectibles

- Decentraland is a virtual world owned by its users built on the Ethereum blockchain, defined by cartesian coordinates (x,y). The world is divided into ~90,000 parcels of LAND (NFTs). The entire city (Genesis City) is roughly the size of Washington DC

- Each parcel of LAND is ten square meters and can be bought and sold using Decentraland’s cryptocurrency MANA. Users can create, experience, and monetize content and applications on LAND using Decentraland’s SDKs

- The parcels are NFTs whose ownership is recorded on the Ethereum blockchain using the ERC721 standard

- Once VR technology becomes interchangeable with reality, colonization of new worlds will become the focus. MANA NFTs make colonization possible

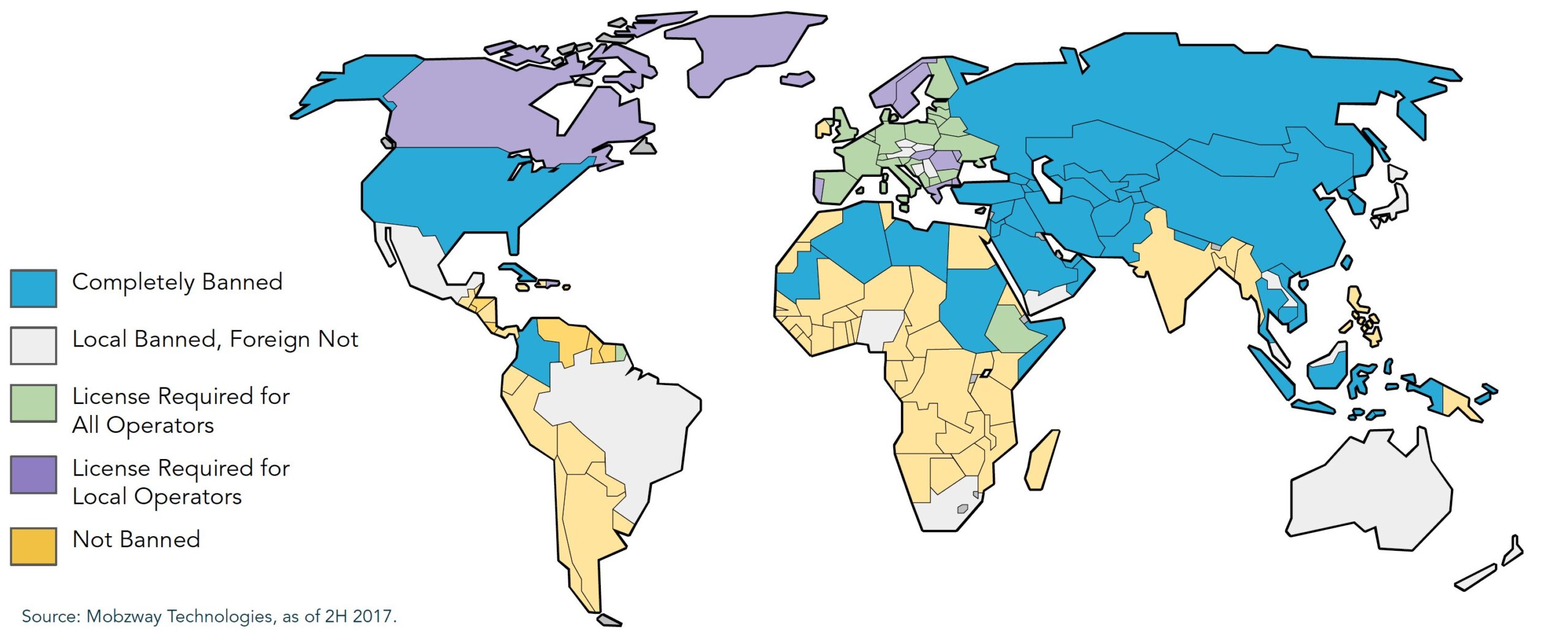

Legality of Online Gambling Today

Online gambling operations are predominantly banned in Eastern Europe and the US, legal in Africa and South America, regulated in Europe and have mixed regulations throughout Southeast Asia

The Rise of Online Gambling

Online gambling is a burgeoning industry that’s becoming mobile and consolidating. Yet as it grows, its trust and authenticity issues are becoming more onerous

Explosive Growth

- According to a report published by British consulting company Juniper Research, the growing demand for digital products will drive the online gambling market to $1 trillion by 2022, with the total number of online gamblers exceeding 684 million

Mobile

- H2 Gambling Capital believes that by 2023, over 50% of gross online gambling revenues will come from mobile devices. As of September 2018, 68% of mobile revenue comes from betting

Consolidation

- According to data provided by Global Betting & Gaming Consultants, in the past few years the global gaming market has been characterized by a consolidation of assets by such companies as Paddy Power, Betfair, Ladbrokes, Coral, Bwin, and GVC Holdings

Future Growth Driven by Sports Betting

United States – the fastest growing sports betting market

- May 2018: Supreme Court strikes down law banning sports betting outside Nevada

- June 2018 to November 2018: 7 states (Delaware, Mississippi, New Jersey, New Mexico, Pennsylvania, Rhode Island, West Virginia) legalized full scale sports betting

- Seven additional states have passed a bill, but full legalization is pending

United Kingdom / Europe: The longest-standing sports betting market

- Online betting has been largely regulated in the UK and Europe for the past two decades

- The UK is the largest regulated online market in the world, generating ~£5.6 billion ($7.0 billion) in gross revenue each year

Asian-Pacific Region (APAC): the largest sports betting market by market share

- Residents falling in the APAC region are responsible for 47% of the world’s sports wagers

- Even so, APAC is projected to witness major growth in the upcoming years because of the improving economic conditions throughout the region (increasing disposable income for population base of more than 4 billion people)

Hottest Sports Betting Market is eSports

eSports is the fastest growing sector in the expanding sports betting market, a indication of the rise in popularity of virtual competition

The Flaws in Online Gambling

- Users cannot be certain whether the gambling website is working against them by tweaking the odds in favor of the house

- Platforms themselves have to bear the risk that their clients might cheat

- Because countries restrict online gambling, the operator has the ability to block a user from withdrawing of funds after winning a jackpot

- Unlike banks, players’ deposits are not insured if an operator is shut down, becomes insolvent, is seized, or goes offline

- Bad actors can register multiple accounts by using remote server connections to give the appearance of operating in a different jurisdiction, making it easier for them to move money undetected

- If a hacker steals money from the website, both operators and users suffer

As the online gambling market continue to advance and proliferate, it is imperative these flaws be addressed in conjunction

The Solution: Blockchain-Based Online Gambling

- The implementation of blockchain technology will make the operations of gambling websites more transparent, allowing each party to verify that the gambling process is fair. We believe it will also solve the issue of security

- Transaction costs can be reduced dramatically, and money withdrawals will be much faster. While payout withdrawals presently take between three to five days, cryptocurrency transactions are almost instantaneous

- The use of cryptocurrency will attract new clients to the market – those who cannot use centralized gambling sites due to a lack of access to banks or residency in a country where financial institutions do not allow gambling transactions

Degree of Cryptocurrency’s Impact on Online Gambling

There are degrees to how cryptocurrency can impact online gambling / sports betting

- Using cryptocurrency to gamble on non-digital assets

Example: using Bitcoin to wager on real world professional sports - Using cryptocurrency to gamble on digital assets

Example: using Bitcoin to wager on eSports or online poker - Future: using cryptocurrency to gamble on NFTs

Example: using Bitcoin to bet on a digital horse participating in the Virtual Kentucky Derby

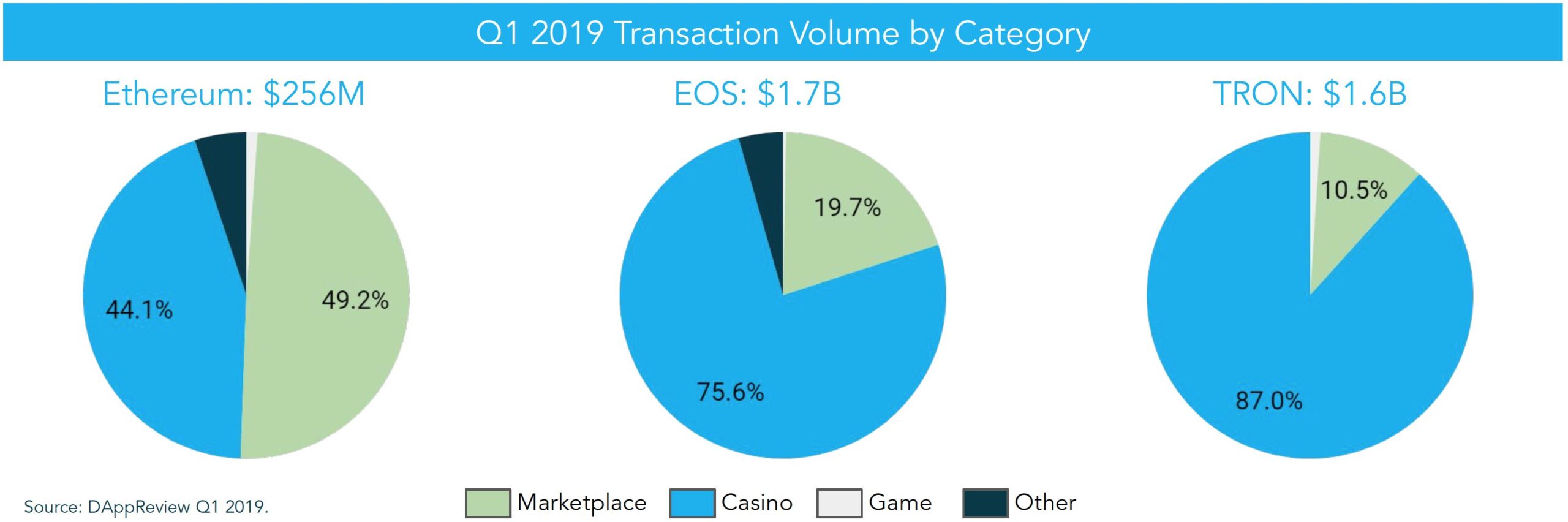

Ethereum versus EOS and Tron

- Driven by a) throughput advantages and as compared to Ethereum and b) zero transaction fees to users, Tron and EOS have become the preferred mainchains for blockchain gambling dApps

- Cost and scalability will ultimately determine which networks see the majority of interactive games built on them

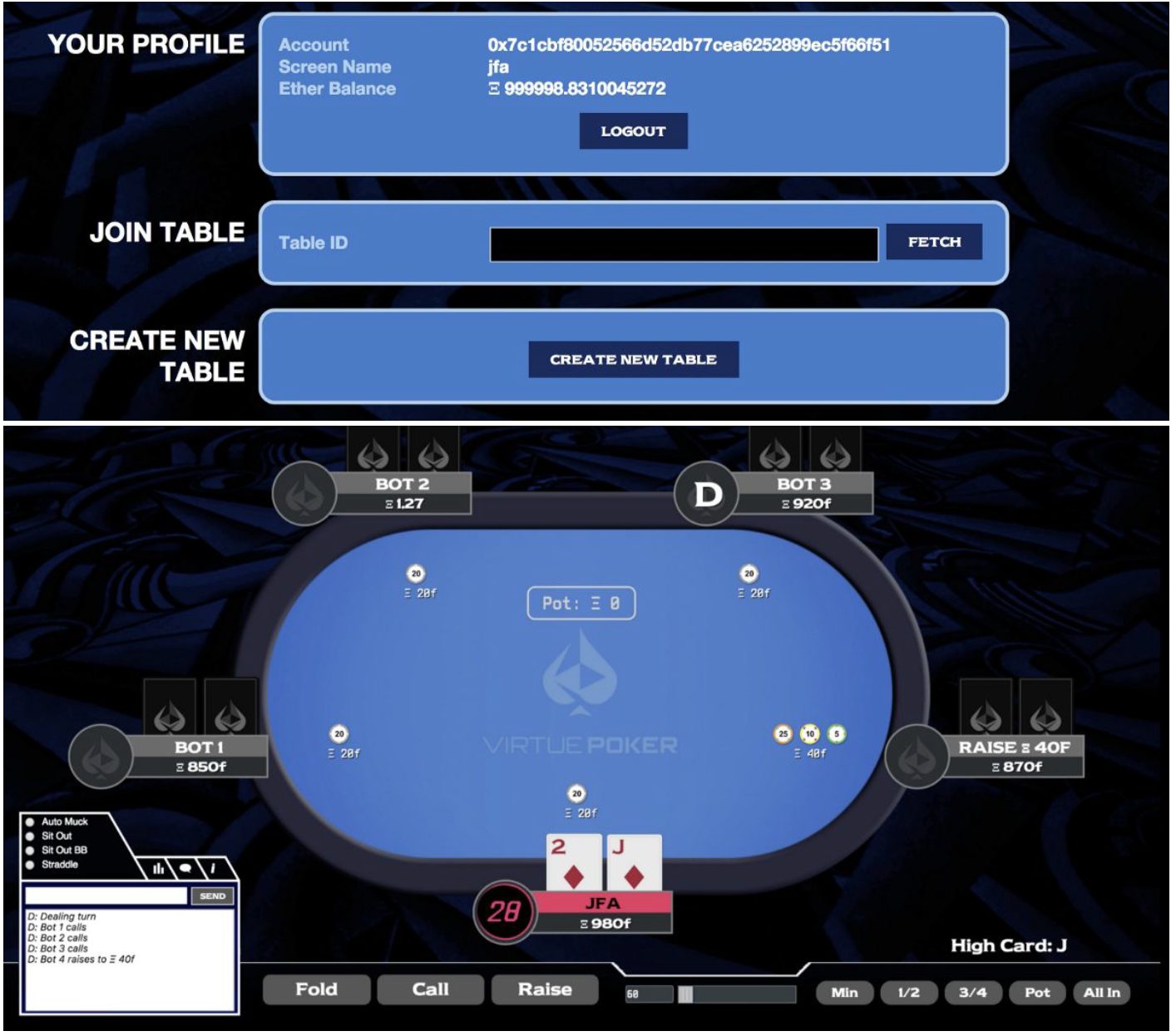

Case Study: Virtupoker

Virtupoker has built an end-to-end protocol using digital wallets and Ethereum smart contracts to bring transparency to online poker

- By registering, players are issued a wallet and can send either ETH or VPP (native ERC20 cryptocurrency) to their wallet address

- A poker table on Virtupoker uses an Ethereum smart contract which includes the custom parameters of the game (# of players, game type, buy-in amount, etc). Players join a table by sending the buy-in amount to the table address and waiting for the transaction to confirm

- When a player leaves a table or when a tournament is over, the table contract auto-executes and pays out each player balance owed directly back to their wallet

Distribution of the presentation is strictly prohibited. Nothing in this presentation should be construed as an investment offer. This presentation is intended for information purposes only. Wave Digital Assets is the brand name for Wave Digital Assets Group. Subsidiaries include Wave Digital Assets LLC a registered investment adviser CRD # 292343. More information can be found at www.adviserinfo.sec.gov.

Wave Digital Assets is not a broker-dealer, and will not engage in any activities requiring registration as such. Wave Digital Assets is not licensed to provide tax, legal or accounting advice and will not do so. Wave Digital Assets will use its commercially reasonable efforts to reach the client objectives, but there is no warranty or guarantee that such can be achieved. Services requiring advisory registration are provided by Wave Digital Assets LLC.