Redefining Digital Currency with AI Profits and Orbs

07.26.2023

Market Overview

ChatGPT Creators begin trading their Worldcoin (WLD)

The idea for Worldcoin originated in 2020 when co-founders Alex Blania, Sam Altman, and Max Novendstern envisioned widespread distribution of a new digital currency with the idea of equitably distributing AI-generated profits and to address income inequality through its unique World ID feature utilizing Orbs. However, this Worldcoin (WLD) should not be confused with the existing Worldcoin (WDC) cryptocurrency deployed in May 2013 and still in circulation today (https://coinmarketcap.com/currencies/worldcoin/).

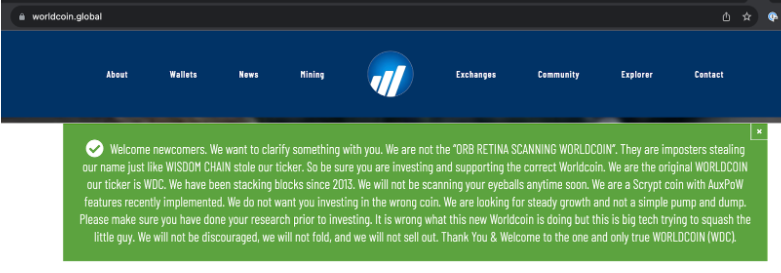

And this begs the question of why people who are supposed to be intelligent individuals use the same name for their new digital currency as an existing cryptocurrency that has been in existence for a decade? Lack of due diligence? Maybe (see webpage notice from WDC below):

It is important to note there is are major differences between WLD and WDC as digital assets:

1) WLD, co-created by Sam Altman, is an ERC-20 Layer 2 (L2) contract minted token digital asset coded as a currency. The introduction of the token project is finalizing its migration to the Optimism network, an L2 scaling side chain on Ethereum that utilizes rollups for L2 contract execution and bridges for interoperability with non-Ethereum distributed ledgers. I believe there are some serious problems regarding the security architecture as there is no cryptography in L2 protecting token assets. Even the airdrop of Optimism’s governance token (OP) was a bit of a disaster. More on the problems side Optimism later.

2) On the other hand, WDC is an actual cryptocurrency, meaning it is a Layer 1 (L1) digital currency asset that is protected by cryptographic protocols by using consensus protocols such as Scrypt (pronounced “ess crypt”) PoW (Proof-of-Work), which is also used in Litecoin, Dogecoin, and several other cryptocurrencies. For context, the Bitcoin network uses the Hashcash PoW cryptographic consensus protocol.

Below is the trading chart from 7/25/2023 for WLD:

The introduction of the Optimism deployed WLD ERC-20 currency token also means the project is finalizing its Orb availability, which is ramping up worldwide. The Orb will be used by developers that have access to the Worldcoin software development kit (SDK) to create tools and apps using the World ID, the project’s identity software. In order to be fully verified, users must scan their irises using the Orb, a tailor-made device that uses the scan to create a unique identifier, but doesn’t process or store any related data locally according to Tools for Humanity, the company manufacturing the Orb. The Orbs are reportedly being manufactured in Germany.

The Orb scans will be tokenized into an ERC-20 token on Optimism, alongside the currency ERC-20 token, and will also employ AI. The use of biometric data has raised eyebrows according to Tools for Humanity representatives, but the company says it uses artificial intelligence to create unique codes to represent the scans and complies with “very, very local and very specific rules and regulations in each of the markets where there’s an Orb.”

Up to now, some 200 Orbs have been made available with the firm planning to make 1,500 Orbs by the end of the year, and add the option to book appointments as opposed to pop-ups. According to the company’s whitepaper, the Orbs have scanned over 2 million people: 32% of them in each of Asia and Africa, 19% in Latin America, and 17% in Europe.

To circle back to the security issues noted above, L2 is not a cryptographically secured layer in the stack, and the stacking of a mainnet (L1) with an L2 side chain utilizing a DID (Digital IDentification) contract, a currency contract token, and ZK rollups with the potential to connect with bridge contracts to other distributed networks, in my experience as a DLT architectural engineer, is a major security concern. All one has to do is look at the many distributed finance exploits that have taken place in just the past two year and they have involved exploits of the contracts that were developed for the L3 DApp (Distributed Application) layer – this is where a contract is interfaced with a website and what many erroneously refer to as Web3. This looks like a playground for cybercriminals because I have seen no published penetration testing of the web GUI (Graphic User Interface) or security audits of the underlying contracts.

NFT Market News:

OpenSea, a leading Non-fungible token (NFT) marketplace, has introduced a new feature, “Deals,” aiming to facilitate peer-to-peer NFT trading. This tool allows enthusiasts to trade NFTs directly and incorporate wrapped ether (WETH) to make their deals more appealing. The innovative feature is powered by OpenSea’s in-house NFT protocol, Seaport, and seeks to provide a secure environment for NFT trading, helping to avoid potential pitfalls of dubious direct messages and questionable trading platforms.

To start a deal, users can enter their trading partner’s username, ENS name, or wallet address, select up to 30 NFTs, and decide the amount of WETH they want to add to the swap, if any. After this, they choose the assets they wish to trade and submit the deal for evaluation. Currently, OpenSea requires no transaction fees for “Deals” swaps and doesn’t demand creator royalties. This initiative aims to simplify the NFT swapping process and grow the user base in NFT communities, while maintaining safety and reliability of trades on OpenSea.

Source: https://www.coindesk.com/web3/2023/07/20/opensea-makes-deals-launches-peer-to-peer-nft-swaps/

Latest News:

WELCOME FRIENDS: Hundreds of institutions and prominent individuals have invested directly in crypto, adopted the value thesis, or started building technology to support digital assets since Wave started tracking these developments in late 2020. Now the rise of the Metaverse, Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs) is driving mainstream adoption of blockchain technologies everywhere we look. We’re continuing to keep track of it every week here:

- The development firm behind the Chainlink protocol and its native LINK token has gone live with its cross-chain protocol, aimed at providing interoperability between traditional financial firms and both public and private blockchains. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) launched with early access on Ethereum, Arbitrum, Optimism, Polygon, and Avalanche. The service uses Swift’s messaging infrastructure, which is used by over 11,000 banks around the globe to facilitate international payments and settlement. BNY Mellon, BNP Paribas, Citi, and various other financial institutions are reportedly exploring the use of CCIP.

- Gnosis Card, which uses the Visa payment system, will be a debit card directly connected to a user’s on-chain account, built on the Gnosis Pay decentralized payment network. Users’ wallets – in this case smart contract-based Safe wallets – will act like a bank account for the debit card, and every Gnosis Card will be connected to the user’s Safe account. Gnosis Pay will also operate as a layer 2 to the Gnosis chain, therefore enabling faster and cheaper transactions.

- The South Korean commercial banking giant Shinhan Bank completed an EMV-compatible feasibility test for stablecoin remittance payments on the Hedera network.

REGULATORY ROUNDUP: We’re living through the era of regulatory recognition of digital assets. The legislation, litigation, and regulation happening today will dictate the entire future of our industry, and we have a historic chance to shape those changes by staying informed and providing public commentary.

- The United Kingdom’s HM Treasury has rejected a House of Commons Treasury Committee recommendation to classify crypto trading as gambling, stating that it “firmly disagrees” with it. A cross-party Committee of MPs proposed the law change in May 2023.

- U.S. House Republicans introduced a new digital assets oversight bill on Thursday that aims to establish a regulatory framework to protect investors in the crypto sector. “Today’s introduction of the Financial Innovation and Technology for the 21st Century Act marks a significant milestone in the House Committees on Agriculture and Financial Services efforts to establish a much-needed regulatory framework that protects consumers and investors and fosters American leadership in the digital asset space,” said Chairman of the House Committee on Agriculture Rep. Glenn “GT” Thompson (R-Pa.) in a statement. The bill, one of several introduced in recent years that aim to create comprehensive rules for digital assets, comes at a time when a perceived lack of regulatory clarity and a wave of aggressive enforcement actions are spurring established crypto businesses to consider leaving the U.S., and deterring startups from forming there.

Disclaimer: The views and opinions expressed herein are those of the author alone and do not represent Wave Digital Assets LLC or any of its affiliates (collectively, “Wave”). The author and/or Wave may hold investment positions in some of the assets discussed. Nothing in this material or linked information should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product. This material is not intended to provide accounting, legal or tax advice. Certain information contained herein has been obtained from third-party sources, has not been independently verified and should not be viewed as being endorsed by Wave. Such information is believed to be accurate as of the date of its publication. No representation or warranty is made, express or implied, with respect to the accuracy or completeness, and readers should not place undue reliance on the information contained or linked to herein. Certain statements in this material provide predictions and there is no guarantee that such predictions are currently accurate or will ultimately be realized. Past performance is not indicative of future results.

Wave is federally regulated by the US Securities & Exchange Commission as an investment adviser. Registration with a federal or state authority does not imply a certain level of skill or training. Additional information including important disclosures about Wave Digital Assets LLC also is available on the SEC’s website at www.adviserinfo.sec.gov. Or, learn more information about Wave at www.wavegp.com.