Monolithic vs. Modular Architecture in the Blockchain Landscape

01.26.2024

Wave Leadership Thoughts – By Shant Ganoumian, DeFi Analyst

The Future of DeFi: Monolithic or Modular?

Recent discourse amongst the DeFi community has shifted towards a focus on an increasingly popular form of blockchain infrastructure: Modularity.

Source: https://medium.com/blockchain-biz/understanding-the-rivalry-between-modular-vs-monolithic-blockchains-6429f9a55e5

Spurred by the success of the launch of Celestia ($TIA), a modular data availability network that aims to be among the most efficient, cheap, and secure DA layers, there is positive sentiment in the market toward the future of modularity.

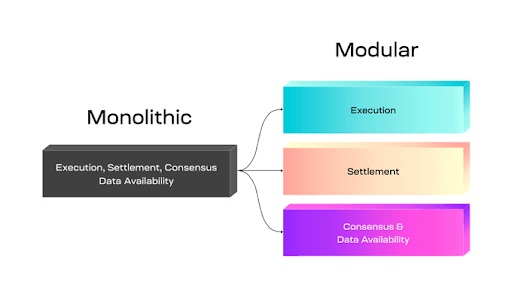

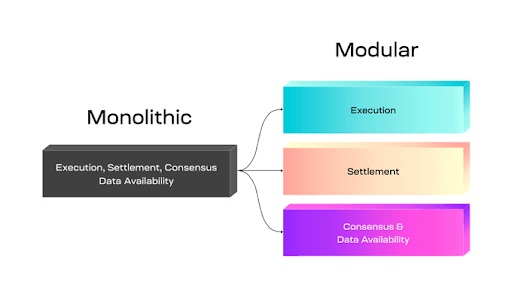

Historically, the most successful and popular blockchains such as Ethereum, Solana, and Tron have used a monolithic structure. A monolithic DeFi infrastructure consolidates all core functionalities such as data availability, consensus, settlement, and execution into a single, integrated system. While providing a seamless experience for users and developers, this approach is susceptible to systemic risks. A vulnerability in one part of the system can potentially compromise the entire network. Further, centralization risk arises as only in-house development teams have full access to chain architecture.

On the other hand, a modular DeFi system embraces a more fragmented approach with distinct components operating independently, allowing for greater flexibility and scalability for blockchains. The modular architecture promotes innovation, as developers can create and upgrade individual layers of chains without affecting an entire ecosystem. While this minimizes systemic risks, it introduces challenges in terms of interoperability and user experience. Modularity leads to fragmentation of liquidity and the requirement of unnecessary bridging technology, which is a roadblock for users and developers.

The answer may be that there should be a balance between the monolithic and modular approaches. One that combines the streamlined user experience of monolithic systems with the innovation of modular systems could be the key. As the DeFi space continues to evolve, finding solutions to enhance security, interoperability, and user experience will be crucial. Ultimately, it will be the industry’s ability to address these challenges that will shape the trajectory of the ecosystem.

Sam Eisner, Vice President

Latest News:

WELCOME FRIENDS: Hundreds of institutions and prominent individuals have invested directly in crypto, adopted the value thesis, or started building technology to support digital assets since Wave started tracking these developments in late 2020. Now the rise of the Metaverse, Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs) is driving mainstream adoption of blockchain technologies everywhere we look. We’re continuing to keep track of it every week here:

- Japanese e-commerce giant Mercari will start accepting Bitcoin payments for its flea market app-listed products from June. Users will have the option to pay in Bitcoin, with vendors and sellers receiving the payment in local fiat currency. Mercari, with 22 million monthly users, aims to encourage further adoption of Bitcoin in Japan, a tech-savvy nation with favorable crypto regulations. The company has already embraced cryptocurrency on its platform, offering services such as the Mercari Bitcoin crypto trading service and a loyalty program that allows users to swap points for cryptocurrency.

- BitGo has received in-principle approval from the Monetary Authority of Singapore (MAS) to operate as a Major Payment Institution (MPI).

- PayPal recently enlisted the help of crypto solutions provider Trident Digital, a digital asset lending platform, to increase liquidity and use of its PYUSD stablecoin across DeFi. Trident’s first move was to set up a liquidity pool on Curve Finance, one of the most popular places to trade stablecoins in DeFi. It also provided over $132,000 worth of bribes: incentives paid out to those who provide liquidity for PYUSD on Curve. Additionally, Trident proposed that lending protocol Aave let its users lend and borrow against PYUSD. A preliminary vote that ended last week showed Aave token holders overwhelming support the idea. Trident’s push to boost PYUSD liquidity appears to be working, as over the past month, PYUSD has increased its circulating supply by over 33% to over 294 million.

- Sports apparel giant Nike’s blockchain and digital wearables division, .Swoosh, said that it will push further into the video game space in the coming year.

- The cloud division of tech giant Google (GOOGL) has joined the Flare blockchain as a validator and infrastructure provider. Google Cloud is one of 100 organizations adopting this combined role, both securing the network as a validator and contributing to the Flare Time Series Oracle (FTSO).

- China has formed a working group to push for standardization for the metaverse sector, as the world’s second-largest economy looks to drive the growth of the nascent industry. The Ministry of Industry and Information Technology (MIIT) said in a notice that it has formed a working group with representatives from the government, academia and corporations. Members of the working group include those from Chinese tech giants, such as Huawei, Ant Group, Tencent, Baidu, NetEase and Sense Time.

REGULATORY ROUNDUP: We’re living through the era of regulatory recognition of digital assets. The legislation, litigation, and regulation happening today will dictate the entire future of our industry, and we have a historic chance to shape those changes by staying informed and providing public comment.

- The Bank of Spain has selected three companies, Cecabank, Abanca, and Adhara Blockchain, as partners for testing central bank digital currency (CBDC). These companies were chosen from 24 applications received by the central bank over the past year. The pilot testing of the wholesale CBDC will take place over the next six months and will involve simulating the processing and settlement of interbank payments using a single tokenized wholesale CBDC and multiple wholesale CBDCs issued by different central banks. The Spanish CBDC program is separate from the digital euro project that would cover all economies in the eurozone. The Spanish Ministry of Economic Affairs and Digital Transformation has also announced its intention to implement the European Union’s Markets in Crypto-Assets Regulation ahead of schedule. However, a survey showed that only 20% of Spaniards expressed interest in using the digital euro.

- Two U.S. Senators, JD Vance and Thom Tillis, have written a letter to Securities and Exchange Commission (SEC) chair Gary Gensler demanding an explanation for a fake tweet from the SEC’s Twitter account. The tweet falsely claimed that multiple spot Bitcoin ETFs had been approved. The Senators expressed concern and requested clarity regarding the SEC’s social media communications and raised serious concerns over the regulator’s cybersecurity procedures. They also demanded that the SEC explain its plans to investigate the error and rectify any financial losses borne by investors as a result of the fake announcement. The SEC’s Twitter account was compromised, leading to extreme volatility in the price of Bitcoin. The SEC and Twitter have conducted preliminary investigations into the incident, with Twitter stating that the compromise was due to an unidentified individual obtaining control over a phone number associated with the @SECGov account.

- The SEC is seeking a court order to compel Ripple to provide financial statements and sales contracts. This comes after Judge Analisa Torres issued a summary judgment in the case, ruling that institutional sales of Ripple’s XRP token constitute an unregistered securities offering, while programmatic sales do not. The SEC is now requesting Ripple’s financial statements from 2022 and 2023, as well as contracts related to institutional sales after the SEC filed its initial complaint in December 2020. The SEC argues that this information is necessary to determine the injunctions and civil penalties Ripple should face. The deadline for remedies-related discovery is approaching on February 12, and the SEC claims that Ripple has not produced any post-complaint discovery. The parties may still reach a settlement agreement regarding remedies, subject to court approval.

- USDC stablecoin issuer Circle has confidentially filed for an IPO with the SEC, marking its second attempt at going public. The company previously planned to go public in 2022 but the deal fell through.

- Nebraska has proposed a bill to revamp the state’s crypto and Bitcoin mining structures, licenses, and ownership. Introduced by State Senator Eliot Bostar on Jan 5, the bill is expected to adopt the Blockchain Basics Act, establishing new industry standards within broader regulations. The legislation aims to recognize the fundamental rights of Bitcoin holders, fostering a thriving ecosystem and ensuring freedom. The bill reaffirms the right to self-custody of assets, emphasizing the decentralized nature of the market. This move holds significance amid increased institutional interest and potential spot ETF approval, providing greater legal backing to the asset class.

- Financial Industry Regulatory Authority (FINRA) has released its 2024 Annual Regulatory Oversight Report, featuring a section dedicated to crypto assets for the first time. As the U.S. self-regulatory organization overseeing securities broker-dealers, FINRA mandates membership. The report, described as a tool for member firms’ compliance programs, includes new topics such as Crypto Asset Developments and Advertised Volume. The crypto section targets firms involved or planning to engage in crypto-related activities, with a focus on private placements, alternative trading systems for crypto asset securities, and custody services.

- Venezuela is discontinuing its Petro cryptocurrency, over five years after its 2018 launch by President Nicolas Maduro to support the bolívar amid economic challenges from U.S. sanctions. The token, tied to oil reserves, faced controversy, including opposition claims of illegality and U.S. sanctions on a Russian bank linked to it. The Petro was linked to various initiatives, but a corruption scandal, involving financial irregularities in oil operations, led to the resignation of the petroleum minister and a crackdown on bitcoin mining. Remaining petros are being converted to bolivars.

- Genesis Global Trading, a subsidiary of Digital Currency Group, has agreed to pay an $8 million penalty to the New York State Department of Financial Services (NYDFS) after settling allegations of compliance failures. The NYDFS accused the company of violating virtual currency and cybersecurity regulations, leading to its vulnerability to illicit activities and cybersecurity threats.

- OKX has received regulatory approval from Dubai’s financial authorities to offer retail virtual asset services to customers.

- United States Senators Cynthia Lummis (R-WY) and Bill Hagerty (R-TN) introduced a new bill to combat illicit finance across the crypto sector. The Preventing Illicit Finance Through Partnership Act of 2024 aims to enhance collaboration between federal agencies and private companies to combat illicit financial activities. Senator Hagerty emphasizes that existing tools can be effective with better communication. The proposed bill establishes a pilot program chaired by the attorney general, involving 20 money services organizations. This program enables the sharing of potential instances of illicit finance between federal agencies and private entities. Senator Lummis notes the importance of distinguishing bad actors without hindering the entire crypto industry. The bill is part of various crypto-related initiatives, contrasting Senator Warren’s Digital Asset Anti-Money Laundering Act. Despite opposition from Senator Tillis, Lummis and Hagerty view their bill as a collaborative approach to addressing cryptocurrency challenges and fostering innovation in the financial sector.

DISCLOSURE:

THE OPINIONS EXPRESSED HEREIN ARE THOSE OF THE AUTHOR ALONE AND DO NOT REPRESENT WAVE DIGITAL ASSETS LLC OR ANY OF ITS AFFILIATES. CERTAIN INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES, HAS NOT BEEN INDEPENDENTLY VERIFIED AND IS BELIEVED TO BE ACCURATE AS OF THE DATE OF ITS PUBLICATION ONLY. CERTAIN WAVE ACCOUNTS HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED HEREIN. WAVE AND/OR THE AUTHOR MAY HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED.

NOTHING IN THIS EMAIL OR LINKED INFORMATION SHOULD BE INTERPRETED AS AN OFFER OR RECOMMENDATION TO BUY, SELL OR HOLD ANY SECURITY OR OTHER FINANCIAL PRODUCT. WAVE IS FEDERALLY REGULATED BY THE US SECURITIES & EXCHANGE COMMISSION AS AN INVESTMENT ADVISER. REGISTRATION WITH A FEDERAL OR STATE AUTHORITY DOES NOT IMPLY A CERTAIN LEVEL OF SKILL OR TRAINING. ADDITIONAL INFORMATION INCLUDING IMPORTANT DISCLOSURES ABOUT WAVE DIGITAL ASSETS LLC ALSO IS AVAILABLE ON THE SEC’S WEBSITE AT WWW.ADVISERINFO.SEC.GOV. OR, LEARN MORE INFORMATION ABOUT WAVE DIGITAL ASSETS AT WWW.WAVEGP.COM.