CoinGecko Report Highlights Utility and Community Driven Ownership

04.17.2023

Market Overview:

Quick Crypto Round-up

There have been quite a bit of events that have transpired on the defi and regulatory crypto front. Recently, a judge has rejected Algorand’s $50M USDC claim from 3AC. According to Arbitrum scan, the number of ARB wallet addresses surpassed 5M by April 17, with nearly 200M transactions completed since inception. A total of $1.7B has been withdrawn since the Shanghai and Capella upgrades went live. Validators retrieving their initial stake represent just 5% of pending withdrawals, with the remaining 95% of requests comprising rewards.

Hundred Finance was hacked on Optimism, suffering a loss of $7M. The SEC has filed charges against Bittrex and its former CEO for operating without a license and a US court has issued a summons to Tron’s Justin Sun, threatening default judgment if no response.

More on the tech side, Charles Hoskinson recently teased the rollout of ZK-rollup technology on Cardano, saying more will follow later. This is extremely exciting for the broader ecosystem as there seems to be a large narrative shifting to zero knowledge technology. The London Stock Exchange (LSE) has signed a deal with UK-based GFO-X to clear bitcoin index futures and options, marking LSE’s first step into crypto. Ethereum open interest has hit a 1-year high post withdrawals activation and positive price action. A researcher at the Ethereum Foundation revealed that the IP addresses of ETH stakers are monitored as part of a broader set of metadata, resulting in privacy concerns. Crypto exchange Bitrue suffered a hack of $23M from a hot wallet. The SEC appears to be revisiting exchange definition as it further analyzes DeFi and its use cases within trading. The US House Financial Services Committee published a draft version of a potential landmark stablecoin bill with proposals including a moratorium on stablecoins backed by other cryptocurrencies. The EU parliament will rubber-stamp MiCA next week.

NFT Market News:

NFTs: Utility and Community the Key Drivers of Ownership

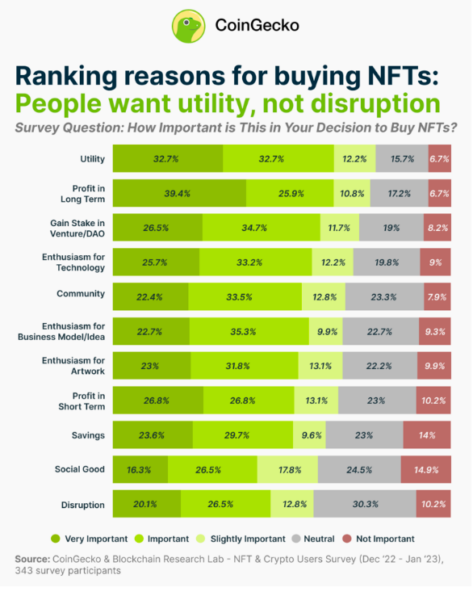

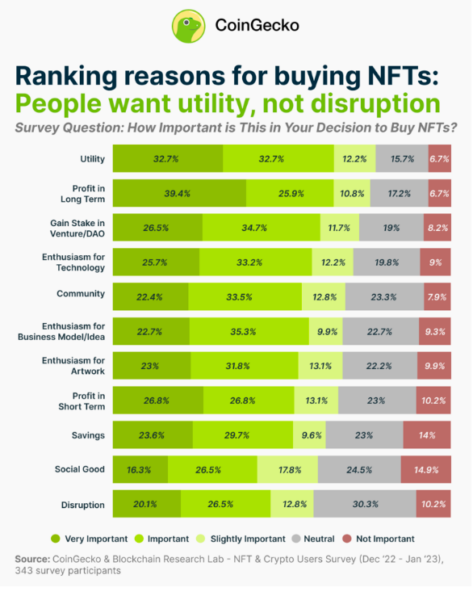

NFTs are becoming increasingly popular among cryptocurrency holders, with over 75% of owners holding at least one NFT, according to a report done on April 11th by CoinGecko. The report also identified the top 11 motivators for investors to purchase NFTs, with utility ranking as the most significant factor in driving purchasing decisions.

NFTs have unique attributes ingrained within the metadata that makes them different from other forms of digital assets. They are not interchangeable, and each token has its own unique identity and value. These unique attributes make them ideal for use in the gaming industry for example where they are commonly used as rewards programs, avatars, gaming assets, land and other gaming ecosystem pieces. Many brands and merchants are now implementing them in their rewards programs, with Adidas, Puma, and Nike launching their NFT’s that derive value from being redeemable for real world assets like track suits and sneakers.

According to the CoinGecko report, 77.6% of NFT owners consider the asset’s value or benefits of ownership before purchasing. However, 15.7% of NFT owners are skeptical of the utility of NFTs and may view them more as collectibles for things like art than anything. This highlights the importance of NFT utility in being the main driver towards ownership. NFTs also have the power to develop novel experiences for communities while promoting a sense of community, particularly when the digital asset can encourage interaction, and brands tokenize their clientele by providing benefits like access to private events and utility. According to the survey results reported by CoinGecko, 68.8% of NFT holders purchase shares because they want to be part of the project team and community, ranking as the fifth most important factor.

CoinGecko’s report cites long-term profitability as the second most important motivation for purchasing NFTs, with 76.1% of owners stating it as a key factor. NFTs have also become a tool for artists and creators to monetize their work, which has built value in return. The market for NFTs has a combined market value of almost $2 billion. Over 92,000 sales worth $69.5 million occurred in the previous 24 hours alone (4/10-4/11), according to CoinMarketCap. Another factor worth noting from this report is that seven out of ten NFT owners are inspired by the opportunity to own a stake in the business or decentralized autonomous organization (DAO). We believe this is important because many see DAOs as an important part of NFT infrastructure and culture with a community element built into the way they are designed. We find this interesting because it may dispel the narrative that many are only interested in NFTs as a means to make money but this report proves that at least 70% of owners are interested in helping to further develop the ecosystem and have a voice in how the sector evolves over time.

It seems clear to us that NFT ownership for now is being driven by utility and community. NFTs have the power to develop novel experiences for holders, promoting a sense of community and providing access to events, exclusive apparel, gaming pieces, and many other forms of utility. It will be interesting to see the creative ways in which NFT founders will evolve the utility they provide to their holders in the future.

Disclaimer: The views and opinions expressed herein are those of the author alone and do not represent Wave Digital Assets LLC or any of its affiliates (collectively, “Wave”). The author and/or Wave may hold investment positions in some of the assets discussed. Nothing in this material or linked information should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product. This material is not intended to provide accounting, legal or tax advice. Certain information contained herein has been obtained from third-party sources, has not been independently verified and should not be viewed as being endorsed by Wave. Such information is believed to be accurate as of the date of its publication. No representation or warranty is made, express or implied, with respect to the accuracy or completeness, and readers should not place undue reliance on the information contained or linked to herein. Certain statements in this material provide predictions and there is no guarantee that such predictions are currently accurate or will ultimately be realized. Past performance is not indicative of future results.

Wave is federally regulated by the US Securities & Exchange Commission as an investment adviser. Registration with a federal or state authority does not imply a certain level of skill or training. Additional information including important disclosures about Wave Digital Assets LLC also is available on the SEC’s website at www.adviserinfo.sec.gov. Or, learn more information about Wave at www.wavegp.com.