A Deep Dive into ETH Restaking with EigenLayer

02.08.2024

Wave Leadership Thoughts (Shant Ganoumian, DeFi Analyst)

Wave Leadership Thoughts (Shant Ganoumian, DeFi Analyst)

ETH Restaking: Powerful Innovation or a Risky Game of Jenga?

In last week’s newsletter, we compared and contrasted modular vs. monolithic blockchain infrastructures. This week, let’s dive deeper and talk about EigenLayer, a leading player within the modularity narrative that has gained immense traction and TVL over the past several months. What is EigenLayer? How does it work? Why does it matter? What are the risks? Let’s get into it.

EigenLayer is an Ethereum-native product that aims to make the development of protocols built on top of Ethereum cheaper, more secure, and more scalable. The protocol commoditizes Ethereum’s decentralized trust network by offering protocols an alternative data availability option, called EigenDA. But what does this mean?

In the current environment, protocols that want to build rollups on Ethereum need to spend a lot of money to either set up their own ETH validator sets or incentivize other validators in order to secure network transactions. This is usually costly and increases the risk of chain centralization

EigenLayer aims to become the marketplace that allows these protocols to ‘rent’ Ethereum base-layer security. This presents a cheaper alternative for protocols and makes their network more secure as they’re using native Ethereum validator sets. It also allows protocols to scale more as they have to spend less capital on securing their network.

Source: EigenLayer

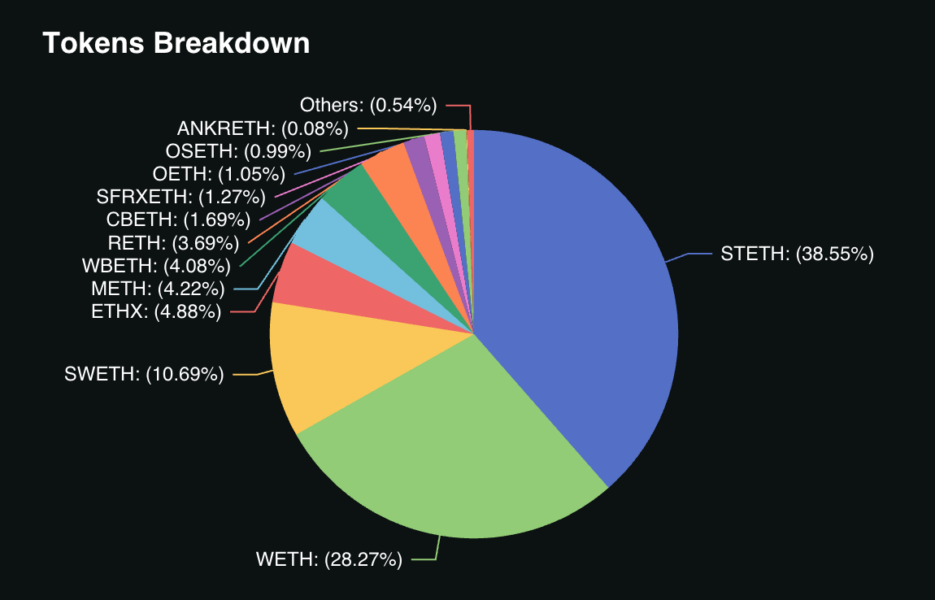

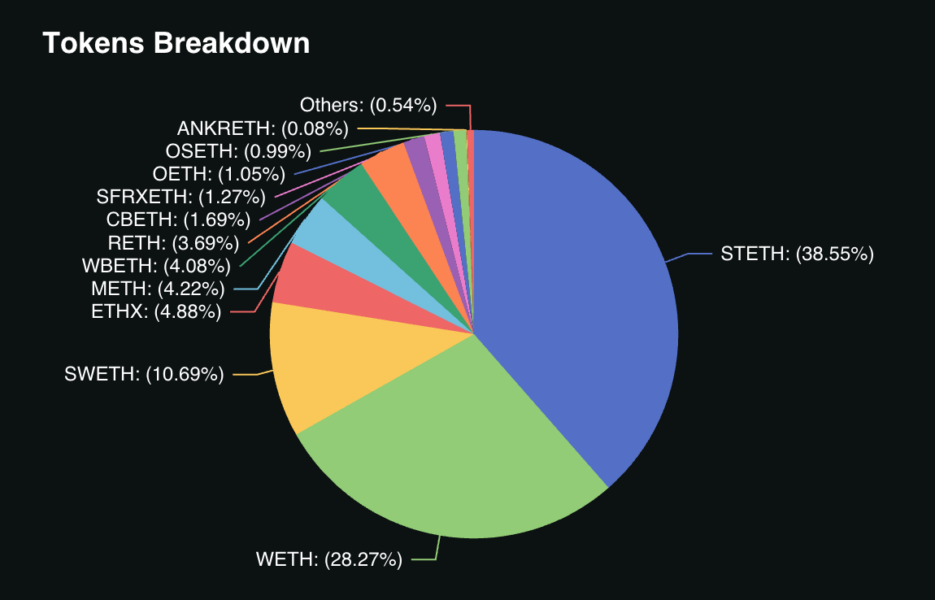

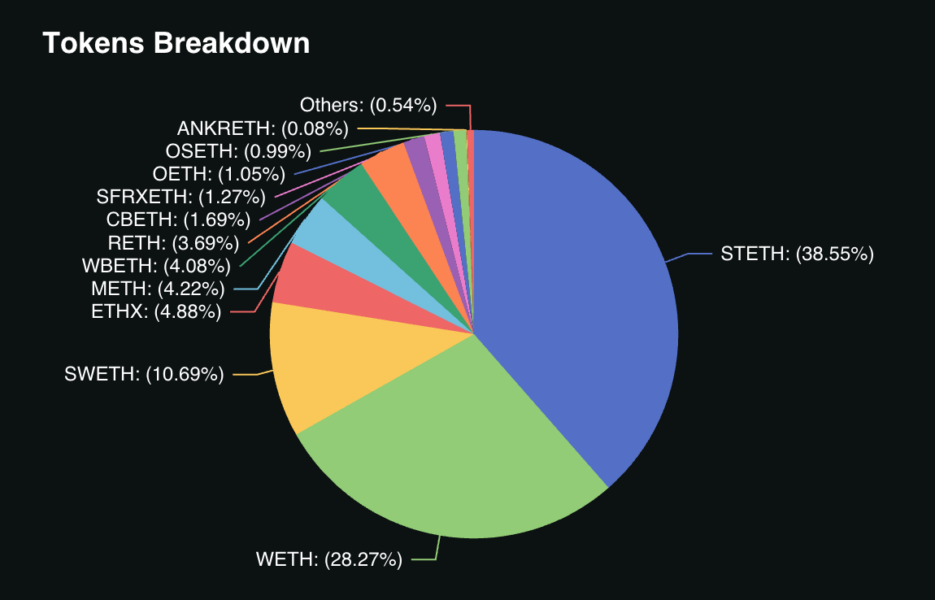

Source: DeFiLlama

ETH holders could also benefit from this system because they get additional staking rewards. Their deposited ETH or LSTs earn native plus additional staking rewards because the underlying validators are being used to secure other networks as well.

With all this being said, there are both benefits and major risks associated with this type of ecosystem:

Benefits

- Increased Security: Protocols can benefit from the security of Ethereum’s base layer.

- Capital Efficiency: Protocols can save on costs and allocate time and capital elsewhere.

- Boosted Yield: ETH holders can earn more yield on their ETH holdings.

Risks

- Magnified Slashing/Smart Contract Risk: User deposited ETH is vulnerable to increased slashing risk as the validators themselves may be working to secure more than one network.

- Centralization Risk: EigenLayer’s popularity has attracted over $4.5 billion in ETH TVL. This can lead to the protocol having outsized influence on the ecosystem.

- Consensus Risk: Allowing for restaking increases risk at the consensus level. Normal validators may end up being forced to engage with the risk of EigenLayer in order to keep up with yield demands or requirements. This could lead to a negative flywheel that enhances all other risks.

Latest News:

WELCOME FRIENDS: Hundreds of institutions and prominent individuals have invested directly in crypto, adopted the value thesis, or started building technology to support digital assets since Wave started tracking these developments in late 2020. Now the rise of the Metaverse, Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs) is driving mainstream adoption of blockchain technologies everywhere we look. We’re continuing to keep track of it every week here:

- Telefónica, a leading global telecommunications provider, has partnered with Nova Labs to deploy Helium Mobile hotspots in Mexico City and Oaxaca. The hotspots, which utilize the crypto-powered Helium 5G network, will allow Telefónica to offload mobile data traffic and extend its coverage in Mexico.

- Visa has partnered with Web3 infrastructure provider Transak to allow users to withdraw cryptocurrencies directly to a Visa debit card. This integration eliminates the need for centralized exchanges and enables users to convert crypto to fiat and make payments at over 130 million merchant locations where Visa is accepted.

- MetaMask, a self-custodial crypto wallet, has partnered with online trading platform Robinhood to allow users to buy cryptocurrencies through the platform. With this integration, MetaMask users can purchase digital assets using Robinhood’s order flow, while Robinhood account holders can fund and transfer their crypto assets to their MetaMask wallet.

REGULATORY ROUNDUP: We’re living through the era of regulatory recognition of digital assets. The legislation, litigation, and regulation happening today will dictate the entire future of our industry, and we have a historic chance to shape those changes by staying informed and providing public comment.

- The High Court of Singapore turned down a plea from the now-defunct crypto hedge fund Three Arrows Capital (3AC) to dismiss DeFiance Capital’s lawsuit filed against the fund. In a recent hearing, Judge Chua Lee Ming gave greenlight to Defiance Capital in its $140 million dispute with 3AC. Further, the court ordered 3AC to pay SG$15,000 and legal disbursements to DeFiance Capital.

- The US SEC has expanded its definition of “securities dealer” to include decentralized finance (DeFi) market makers. Under the new rules, liquidity providers with over $50 million in assets must register with the SEC. The SEC passed these rules on February 6, with three votes in favor and two against. The expanded definition applies to all liquidity providers operating on decentralized crypto exchanges. The SEC clarified that it is not excluding any particular type of securities, including crypto asset securities, from the application of these rules. The new guidelines will take effect 60 days after being published to the Federal Registrar, and market participants will have one year to comply.

DISCLOSURE:

THE OPINIONS EXPRESSED HEREIN ARE THOSE OF THE AUTHOR ALONE AND DO NOT REPRESENT WAVE DIGITAL ASSETS LLC OR ANY OF ITS AFFILIATES. CERTAIN INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES, HAS NOT BEEN INDEPENDENTLY VERIFIED AND IS BELIEVED TO BE ACCURATE AS OF THE DATE OF ITS PUBLICATION ONLY. CERTAIN WAVE ACCOUNTS HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED HEREIN. WAVE AND/OR THE AUTHOR MAY HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED.

NOTHING IN THIS EMAIL OR LINKED INFORMATION SHOULD BE INTERPRETED AS AN OFFER OR RECOMMENDATION TO BUY, SELL OR HOLD ANY SECURITY OR OTHER FINANCIAL PRODUCT. WAVE IS FEDERALLY REGULATED BY THE US SECURITIES & EXCHANGE COMMISSION AS AN INVESTMENT ADVISER. REGISTRATION WITH A FEDERAL OR STATE AUTHORITY DOES NOT IMPLY A CERTAIN LEVEL OF SKILL OR TRAINING. ADDITIONAL INFORMATION INCLUDING IMPORTANT DISCLOSURES ABOUT WAVE DIGITAL ASSETS LLC ALSO IS AVAILABLE ON THE SEC’S WEBSITE AT WWW.ADVISERINFO.SEC.GOV. OR, LEARN MORE INFORMATION ABOUT WAVE DIGITAL ASSETS AT WWW.WAVEGP.COM.

Wave Leadership Thoughts (Shant Ganoumian, DeFi Analyst)

Wave Leadership Thoughts (Shant Ganoumian, DeFi Analyst)