2024 Crypto Overview: Bitcoin ETFs and Ethereum’s Revenge

01.03.2024

Wave Leadership Thoughts (by Nauman Sheikh, Head of Protocol Treasury Management and Derivative Trading)

2024 Outlook

In 2024, the crypto and financial landscape braces for pivotal changes. Here are a few things that I expect with the majors in the short term.

- A potential BTC spot ETF approval is expected within a week. Consensus has been overwhelmingly positive with market participants giving it a 95% probability. We approached the new year with an elevated level of speculative positioning that started to build from October. Open interest in options reached an all time high in 4Q 2023, skewed towards short dated call options with strikes in the 40-50k range. Futures/perps open interest also continued to increase with funding rates above 60%! So is the contrarian trade now to “sell the news’ ‘ or has the “sell the news” also become a contrarian trade? With this degree of leverage, speculators are in a state of cognitive dissonance and extremely trigger happy. One thing for certain is that the days leading up to the announcement are going to be extremely volatile. This was evident today (Jan 3rd) when a broker research report suggested that the SEC is likely to reject the spot BTC ETF in January. This led to panic and an immediate $650m leverage washout in the market with BTC dropping as much as 10% before recovering. Over $2bn of open interest was wiped out. We’re now back down to reasonable levels of leverage and funding rates. The majority of market participants are still positive that the ETF will get approved between Jan 8-10. If it is, we will probably see an immediate up tick in price to $50,000 against a backdrop of healthier market positioning in terms of leverage. (Data source Coinglass)

- ETH will finally have its time in the limelight. In 2023, the most frustrating trade was to be long ETH (up 90%) and the ETH L2s (up only mid-double digit %) as they significantly lagged behind Bitcoin (up155%) and all the alternative L1s, higher by 300-400%. Solana was up an amazing 920% with Dex volumes and Daily Active Addresses surpassing ETH, all driven by a slew of high profile airdrops and meme season driven Tx volume. However the valuation gap relative to BTC and all other L1 is now too wide to ignore especially given metrics like TVL and fees generated. Catalysts for ETH include a) Dencun and EIP4844 upgrades in early Q1 aimed at boosting network efficiencies and reducing tx fees. b) Shift in market focus to a potential ETH ETF launch c) judging by previous bull cycles, ETH has initially always lagged BTC before catching up.

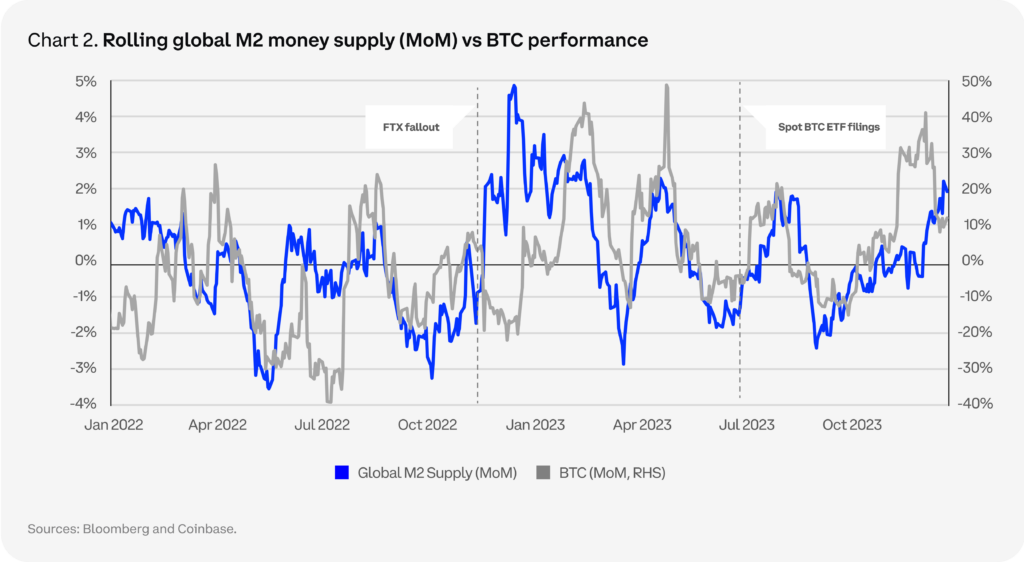

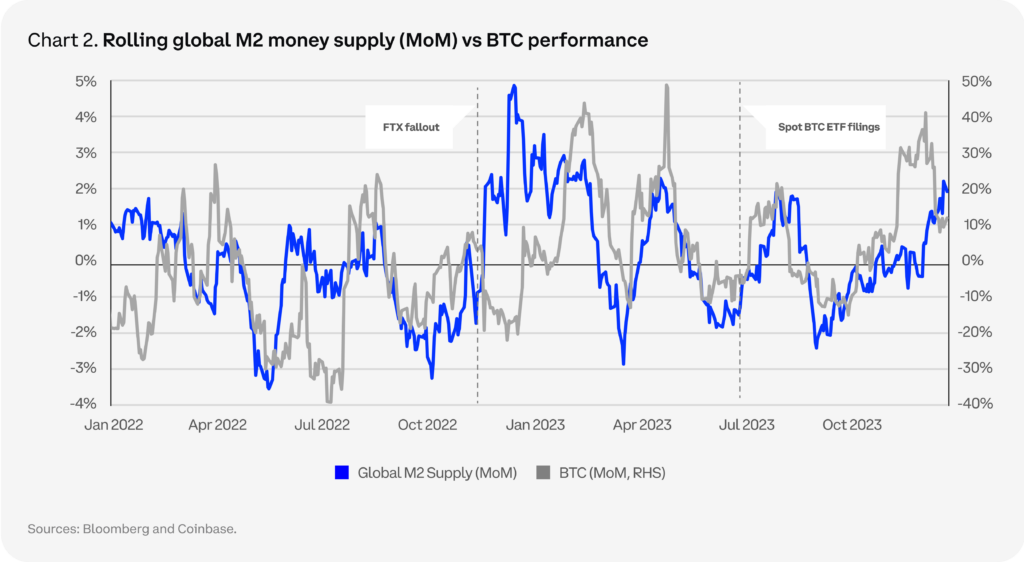

- 2024 is anticipated to be the biggest year ever for democratic elections globally. Over 2 billion voters are expected to participate in elections across 50 countries, including major players like the US and India. This could mean an easier fiscal and monetary policy before elections get into full swing. More liquidity translates into a boost to asset markets and the crypto space could see an outsized benefit.

In 2024, markets are expecting rate cuts in the U.S. and Britain, with the Fed and European Central Bank projected to deliver up to 150 basis points and 110 basis points of cuts, respectively. Indeed, Fed futures are almost fully priced for a cut at all policy meetings between March and July, with even odds of another in September, just before the November election.

Latest News:

WELCOME FRIENDS: Hundreds of institutions and prominent individuals have invested directly in crypto, adopted the value thesis, or started building technology to support digital assets since Wave started tracking these developments in late 2020. Now the rise of the Metaverse, Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs) is driving mainstream adoption of blockchain technologies everywhere we look. We’re continuing to keep track of it every week here:

- Several spot Bitcoin ETF issuers, including Invesco, Bitwise, Valkyrie, and Grayscale, have amended their filings to support in-cash redemptions of ETF shares, bowing to the demands of the U.S. Securities and Exchange Commission (SEC). Initially, these issuers had planned for “in-kind” redemptions, where investors could redeem their ETF shares for the underlying Bitcoin. However, the SEC has shown a preference for in-cash redemptions. The amended filings indicate that while the issuers will execute the creation and redemption of shares in cash, they hope to facilitate in-kind redemptions in the future. The updated applications come after meetings between the SEC and prospective spot Bitcoin ETF issuers.

- FIFA, the famous international governing body for football, has announced a new digital collectible collection in its first collaboration with tech firm Modex – with some notable perks.

- Rulematch, a Swiss crypto exchange for banks, goes live with Spain’s BBVA. The institutional crypto platform uses Nasdaq’s trading tech, and comes out the gates with seven banks and securities firms.

REGULATORY ROUNDUP: We’re living through the era of regulatory recognition of digital assets. The legislation, litigation, and regulation happening today will dictate the entire future of our industry, and we have a historic chance to shape those changes by staying informed and providing public comment.

- The U.S. Commodity Futures Trading Commission (CFTC) is proposing a rule inspired by the collapse of FTX last year to protect customers’ money. The rule would require derivatives clearing organizations (DCOs) to keep customer funds separate from their own funds. The goal is to prevent derivatives firms from misusing or stealing customer funds. If a DCO faces a liquidity crunch, such as a high number of withdrawal requests, customer funds would be protected under the proposed rule. The CFTC commissioners voted to publish the proposal for public feedback, which is a crucial step in the rule-making process.

- The Basel Committee for Banking Supervision (BCBS) has proposed revisions to the criteria for stablecoins to be treated as less risky than unbacked cryptocurrencies like Bitcoin. The BCBS, which is headquartered at the Bank for International Settlements, has released a consultative document outlining the proposed changes. Currently, stablecoins must be redeemable at all times to qualify for preferential regulatory treatment. The proposed revisions aim to tighten the requirements for stablecoins to qualify for this treatment. The BCBS will not be making any changes to the existing standards for cryptocurrencies like Bitcoin, which recommend a maximum risk weight of 1,250% and limit banks to allocating no more than 2% of their core capital to these assets.

- The US SEC has denied Coinbase’s petition for rulemaking, which was filed in July 2022. Coinbase had argued that using existing securities laws to regulate cryptocurrencies is “unworkable.” However, the SEC stated that it has the discretion to determine the timing and priorities of its regulatory agenda and disagreed with the assertion that now is the right time for the suggested regulatory action.

- Brazil signs overseas crypto tax bill into law. Under the new rules, Brazilian citizens will pay the state up to 15% of their crypto profits.

- The Japanese cabinet has proposed scrapping corporate tax on unrealized cryptocurrency gains, a move that aims to boost the development of the country’s Web3 industry. The proposal, which still needs to be debated in the parliament, would eliminate corporate taxation on the difference between the market and book values of crypto assets issued by other companies.

- The Hong Kong Securities and Futures Commission (SFC) has released requirements for the approval of spot crypto exchange-traded funds (ETFs). The SFC issued a joint circular with the city’s Monetary Authority outlining the conditions under which they would approve ETFs with more than 10% of holdings in cryptocurrencies. The circular states that spot crypto investment products should meet the same requirements as mutual funds and other structured investment products. Product issuers must have a good track record of regulatory compliance and employ staff members with relevant experience in managing virtual assets. The regulators will also establish a list of permitted tokens that funds are allowed to hold, which must be available for spot trading on Hong Kong-approved crypto exchanges.

DISCLOSURE:

THE OPINIONS EXPRESSED HEREIN ARE THOSE OF THE AUTHOR ALONE AND DO NOT REPRESENT WAVE DIGITAL ASSETS, LLC OR ANY OF ITS AFFILIATES. CERTAIN INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES, HAS NOT BEEN INDEPENDENTLY VERIFIED AND IS BELIEVED TO BE ACCURATE AS OF THE DATE OF ITS PUBLICATION ONLY. CERTAIN WAVE ACCOUNTS HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED HEREIN. WAVE AND/OR THE AUTHOR MAY HOLD INVESTMENT POSITIONS IN SOME OF THE ASSETS DISCUSSED.

NOTHING IN THIS EMAIL OR LINKED INFORMATION SHOULD BE INTERPRETED AS AN OFFER OR RECOMMENDATION TO BUY, SELL OR HOLD ANY SECURITY OR OTHER FINANCIAL PRODUCT. WAVE IS FEDERALLY REGULATED BY THE US SECURITIES & EXCHANGE COMMISSION AS AN INVESTMENT ADVISER. REGISTRATION WITH A FEDERAL OR STATE AUTHORITY DOES NOT IMPLY A CERTAIN LEVEL OF SKILL OR TRAINING. ADDITIONAL INFORMATION INCLUDING IMPORTANT DISCLOSURES ABOUT WAVE DIGITAL ASSETS LLC ALSO IS AVAILABLE ON THE SEC’S WEBSITE AT WWW.ADVISERINFO.SEC.GOV. OR, LEARN MORE INFORMATION ABOUT WAVE DIGITAL ASSETS AT WWW.WAVEGP.COM.